Shopping for Pennsylvania's Best Dental Insurance

Shopping for the Best Dental Insurance in the Keystone State?

To find the dental insurance that’s best for you, use our 2025 guide to review Pennsylvania dental insurance:

A Brief Guide for Bargain Hunters

While you can’t get rebates or discounts on individual dental insurance plans, you can get more value based on benefits and the cost of a dental plan. Below are two graphics that offer a shortcut to which dental plans might be best for you.

|

Stop Researching & Start Shopping Dental Plans that Have What You Want |

|

| 3 Plans Covering Crowns | Cigna Dental 1500 |

| Ameritas Hollywood Smile Premier Plus 2000 | |

| Careington 500 Series Dental Savings | |

| 3 Plans Covering Implants | Cigna Dental Vision Hearing 3500 |

| Renaissance Dental Plan II | |

| MetLife TakeAlong Dental Medium | |

| 3 Plans Covering Braces for Children | Delta Dental - Dental for Everyone Immediate Coverage |

| Renaissance Dental MAX Choice Plus | |

| Guardian Advantage Diamond | |

| Highest Annual Maximum Benefit | ($5,000 annual maximum) Humana Extend 5000 |

For more information on the above products as well as additional choices, go to our dental insurance comparison tool.

For more detailed information on the California dental insurance market, keep reading below.

Top Plans by Coverage & Cost

Information in the below table is based on a 32-year-old dental insurance applicant in Harrisburgh, Pennsylvania. Plans may not be available in all areas.

How Much Does Dental Insurance Cost in Pennsylvania?

Below is a recent analysis of Pennsylvania dental plans to help you evaluate your dental plan options. To obtain a quote of dental plan premiums for your specific area and age (and relatives if seeking family coverage), visit our dental insurance quote page.

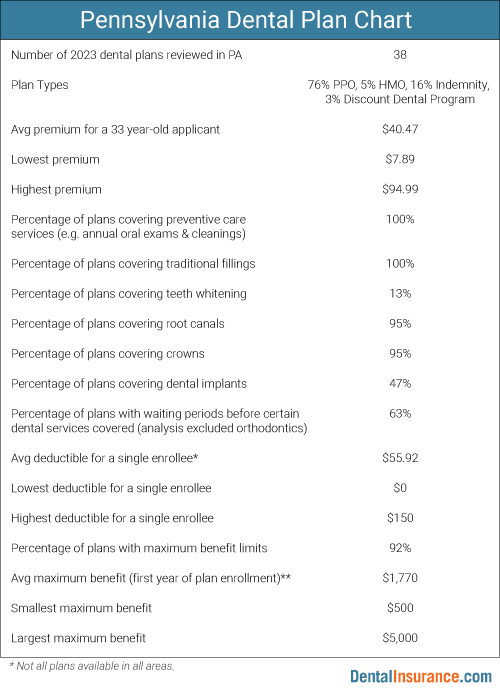

An analysis of 39 dental plans offered in the state of Pennsylvania for 2023 found dental coverage in a variety of forms:

- 76 percent were Preferred Provider Organizations (PPO dental insurance)

- 5 percent were Health Maintenance Organizations (HMO dental insurance)

- 16 percent were Indemnity dental coverage

- A dental discount program (an alternative to traditional insurance) accounted for 3 percent of the options

Some dental plans from Nationwide and Humana also combined vision benefits with standard dental care.

Premiums and deductibles were compared given a standardized applicant profile. The least expensive offering within the study had a monthly premium of $7.89 a month. This plan was the Select Plan Basic, a HMO from Dominion National. The most expensive was the Humana Extend 5000 Dental PPO+Vision dental plan that included additional vision coverage. This plan had a monthly premium of 94.99. Monthly premiums across all 39 Pennsylvania plans examined averaged $39.79 a month.

Deductibles and Out-of-Pocket Costs

Deductibles were inconsistent among plans. 15.4 percent of plans had no deductible. Some plans had a deductible that was waived for certain preventive services. The average deductible was $56.41 per enrollee. For plans charging a deductible, slightly more than half of plans charged a single individual $50 annually. There was a single person deductible as high as $150 but this deductible was only charged once and was not paid again for as long as a person remained continuously enrolled within the dental plan.

Family deductibles were more expensive than individual deductibles, as would be expected. Some plans charged a $50 annual deductible for each family member enrolled. Other plans capped the maximum annual deductible for a family. In some cases, the family deductible was a flat charge (e.g. $150) while in others it was a maximum number of deductibles (e.g. $100 per person with a maximum of three deductibles per family). These capped family deductibles were as low as $75 and as high as $450 (the high deductible was only paid once for as long as the family stayed enrolled within the plan).

With respect to out-of-pocket costs for dental services, charges varied. With respect to budget-friendly options, we found that 64.1 percent of plans examined did not charge a copay for annual teeth cleaning in the first year of coverage. On the expensive end of the spectrum, there were several plans that did not cover high-cost root canals or crowns during the first year of enrollment in the dental plan. Additionally, most plans had a cap on what the dental plan would pay annually toward enrollee dental expenses. The lowest caps (known as a “maximum benefit”) in the first year of coverage were found in Guardian’s Advantage Starter and Advantage Core. Both plans had a $500 maximum benefit. The highest cap was $5,000, found in both the Humana Extend 5000 Dental PPO+Vision dental plan and the NCD Nationwide 5000 Plan PPO. Two HMO plans and one dental discount card had no cap:

- Dominion National Select Plan Basic

- Dominion National Select Plan Premium

- Careington 500

Among the 36 dental plans that capped payments, the average limit was $1,742 annually.

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planBelievable person.

Only sign-up, but person was kind, efficient, helpful and very believable.Leonard Hall

Dental / Vision Application

Thank you for getting back to me in a timely manner with my question that I had with my application with Humana. Please contact me and let me know in the coming days if the application was approved or not. Thanks, Mark SeidenbergMark Seidenberg

What Insurance Companies Offer Dental Insurance in Pennsylvania?”

The 38 plans analyzed for this article represented nine separate insurers:

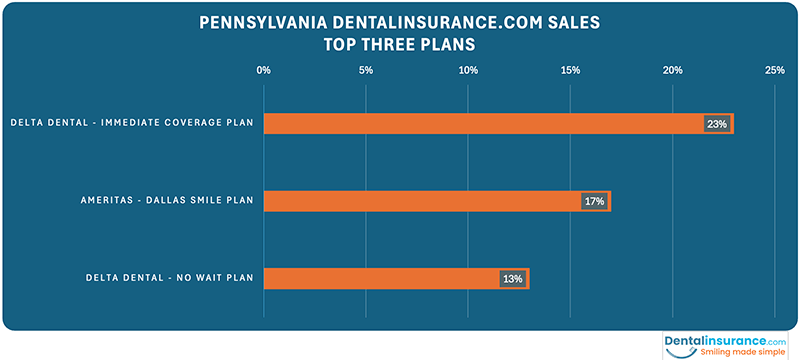

Average Costs Vs A Personalized Rate Quote

With the information provided above, you can compare local rates to larger Pennsylvania cost trends. The following link will provide dental insurance quotes for plans available in your zip code, whether you’re up in Pittsburg, down in Philadelphia, or anywhere in-between. You can also review the plans below, which are DentalInsurance.com’s bestselling plans in Pennsylvania.

Dentistry in Pennsylvania

According to information published by Dentagraphics, Pennsylvania has 3,710 general dental practices and 3,556 specialty dental practices. The average income of a general dentist in the state during 2020 was $155,360 according to the Bureau of Labor Statistics. The United States Census Bureau estimates the state to have nearly 13 million residents in 2021, which produces a ratio of 3,494 Pennsylvanians per general dental practice. Not surprisingly, the government's Health Resources & Services Administration in 2018 determined that there are 58 Dental Health Professional Shortage Areas within the state.

Despite these pockets where dentists are less plentiful, the state has a robust dental plan market as the following section demonstrates.

Need some help choosing a dental plan?

Our agents can:

- Answer your questions

- Confirm if your dentist is in-network

- Enroll you over the phone

Chart of PA Dental Plan Details for this Study

The following chart provides details on the coverage trend in our Pennsylvania dental plan study. Please use this information when evaluating the coverage provided in a dental plan you are considering.

Oral health resources for Pennsylvania Residents

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Pennsylvania Dental Association (PDA)

The Pennsylvania Dental Association, otherwise known by the acronym PDA, is a professional association with about 6,000 members from the dental field. The mission of the organization is to "serve the public, improve their health, promote the art and science of dentistry and represent the interests of its members and the people they serve.” A press release from the organization educated the public on how to find and choose the right dentist.

Public Resources on Dentistry

The Pennsylvania Dental Association provides an online resource that directs consumers to information regarding:

- Free and reduced-fee dental clinics

- Oral care for children

- Finding a dentist who belongs to the Pennsylvania Dental Association

- Making a complaint about dental care

- Articles and videos addressing frequently asked dental questions

Online Tool for Locating Free/Reduced Cost Dental Clinics

This tool enables a Pennsylvanian to select his or her county and see a list of dental clinics that are free or use a sliding scale for costs based on ability to pay.

North Carolinba Dental Insurance News

February 11, 2025

Error-Filled Directories Leave Thousands In PA Unable To Find Health Care Providers (Levittown Now)

"The information that thousands of Pennsylvanians rely on to find health care providers and schedule appointments is riddled with inaccuracies that often go months without being corrected, in violation of federal requirements, according to a study commissioned by the state Insurance Department."

November 1, 2024

Editorial: Expanded dental care benefits save money — and teeth [Pittsburgh Post-Gazette]

"Back in 2011, the Pennsylvania General Assembly passed a bill cutting Medicaid benefits for dental care. While Pennsylvania is still middle-of-the pack for what procedures its low-income insurance will cover, trimming tooth-care is a decidedly poor bet, both financially and for Pennsylvanians' health. The change was estimated to save the commonwealth $18.9 million per year. What happened instead, as the Pennsylvania Coalition for Oral Health estimates based on a 2023 study, is that emergency room dental care costs across the state rose by $35 million annually."

September 30, 2024

Rally in Harrisburg demands adult dental benefits in Medicaid [ABC 27]

"A Pennsylvania organization is demanding dental care be put back in Medicaid coverage. It was cut in 2011. Put People First! PA gathered on the steps of the state capitol building on Monday. Pennsylvanians living without dental benefits shared their stories about the health conditions and hardships they’ve faced."

Frequently Asked Questions

What Is the Best Dental Insurance in Pennsylvania?

Toward the top of the page, we’ve listed our best plans as determined by sales on our website. However, your definition of “best dental plan” may differ. Insurance companies like Delta Dental, Guardian, and Ameritas all have plans that are popular in the Keystone State. When comparing the value of different options against one another, review the number of dental procedures covered (broader benefits are generally considered superior), annual limits on what insurance will pay toward covered care, the out-of-pocket costs for dental services, the monthly premium, and whether there are any waiting periods that delay the availability of a procedure.

What Does Dental Insurance Cover in PA?

Pennsylvania has a wide variety of plans. These plans range in coverage but many plans have comprehensive benefits covering preventive care (teeth cleanings, oral exams, x-rays), basic care (fillings, extractions), and major care (root canals, crowns, implants).

What Should I Do if my Insurance Doesn’t Cover a Procedure I Need?

If your dental plan can be cancelled within a month or so, consider replacing it with a new plan that covers the services you need. If you do replace your plan, make certain the new plan 1) covers the procedure you need, 2) does not delay your access to the needed procedure through a “waiting period,” and 3) provides a level of cost-sharing that is worth more than what you pay annually in monthly premiums for the insurance.

Is Dental Insurance Better than a Discount Dental Plan?

There is no clear answer here because the choice between traditional insurance and a discount plan is related to oral health needs, financial considerations, and dentist choice. Discount dental plans offer savings vs retail rates on dental procedures and lack deductibles and waiting periods. However, a discount dental plan typically has a narrow network of participating dentists and no coverage for out-of-network dentists. PPO dental insurance, in comparison, allows the use of out-of-network dentists. These plans, in some cases, may also make sizable contributions to the cost of major dental care.

Are PA Dental Plans the Same as Dental Plans in Other States?

Each state has its own options of insurance companies and plans. Some plans may be offered in multiple states. However, even if the same plan is offered, the price in one state may be different than is the case in another state. Additionally, factors such as state regulations or laws may affect the benefits.

Is a Well-Known Dental Brand a Safer Choice than a Local Dental Plan?

Not necessarily. In some cases, a local brand may have developed because of a high population concentration (such as found in the Los Angeles area) and the ability to create a compelling network of local dentists.

Is Delta Dental Good Dental Insurance?

Delta Dental products are the most popular dental insurance in the U.S. according to covered lives. They offer a variety of plans with different levels of coverage. In some states, the local Delta Dental company offers an immediate coverage plan where there are no waiting periods that must be satisfied before expensive dental procedures are covered.

Pennsylvania Dental Insurance News

February 20, 2025

Why Your Dentist May Be Able To Identify A New Alzheimer's Warning Sign [Women's Health]

"New research suggests that certain bacteria in your mouth could play a role in your risk of developing Alzheimer’s. Alzheimer’s disease is a complicated condition, with many different factors that influence when and if a person develops it. But the latest findings suggest what’s happening in your mouth could be linked on some level with your brain health."

October 24, 2024

Pennsylvania College of Technology provides free dental care to children from age 7 up through age 18 [Williamsport Sun-Gazette]

"On Saturday, Nov. 9, Pennsylvania College of Technology will provide free dental care to children and teens ages 7 to 18...From 9 a.m. to noon in the college’s Dental Hygiene Clinic, volunteer dentists and dental hygienists and Penn College students will provide free oral screenings, sealants and education during an activity dubbed “Sealant Saturday.” Appointments are required and can be made by calling 570-320-8007."

September 13, 2024

Medicaid dental policy to save costs did the opposite, lawmakers, health activists claim [SpotLight PA]

"Millions of adults in Pennsylvania rely on Medicaid, but the program, which DHS oversees, typically doesn’t cover much beyond routine dental exams, cleanings, and fillings...Health advocates, however, argue that the change has instead increased medical spending elsewhere as adults seek relief in emergency rooms, which bill at higher rates. They also say the restrictions lead to poor health outcomes and hurt someone’s chances of getting a job if they’re missing teeth."

May 9, 2024

Woman worked on patients in Bucks County dental offices but the state has no record of licenses [PhillyBurbs.com]

"A Middletown woman accused of treating patients as an unlicensed advanced dental assistant for three Bucks County dentists could face additional charges for violating her bail conditions. At a preliminary hearing Wednesday, the Pennsylvania Attorney General’s Office revealed that Rose Calese Horne might have been working for a fourth dentist. When she was arrested in April, Calese Horne, 43, told authorities she was not working and her bail condition included barring her from working in a dental office until her case was finished."