How to Save on The Best Dental Insurance in Texas

In this article

With approximately 29 million residents and over 16,000 dentists, Texas supports a competitive market for dental coverage. Texas dental plans differ by benefits, covered dentist, and price. This guide will help you quickly find the best plan for you. We provide consumers with:

With this information, you can move from shopping on premium alone to comparing dental plans’ value for your dollar.

A Brief Guide for Bargain Hunters

While you can’t get rebates or discounts on individual dental insurance plans, you can get more value based on benefits and the cost of a dental plan. Below are two graphics that offer a shortcut to which dental plans might be best for you.

|

Stop Researching & Start Shopping Dental Plans that Have What You Want |

|

| 3 Plans Covering Crowns | Humana Extend 2500 |

| Ameritas Hollywood Smile Premier Plus 2000 | |

| Cigna Dental Vision Hearing 3500 | |

| 3 Plans Covering Implants | Ameritas Dallas Smile Plan |

| Renaissance Dental Plan II | |

| Delta Dental Dental for Everyone No Wait | |

| 3 Plans Covering Braces for Children | Renaissance Dental Max Choice |

| Guardian Advantage Diamond | |

| Delta Dental Dental for Everyone Platinum | |

| Highest Annual Maximum Benefit | ($10,000 annual maximum) NCD Complete by MetLife |

For more information on the above products as well as additional choices, go to our dental insurance comparison tool.

For more detailed information on the California dental insurance market, keep reading below.

Best Texas Dental Insurance

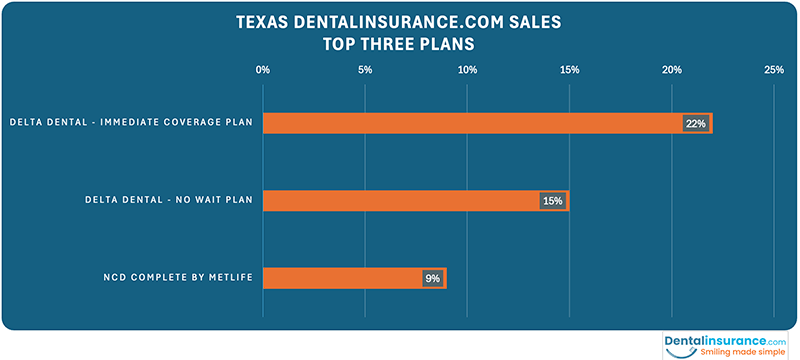

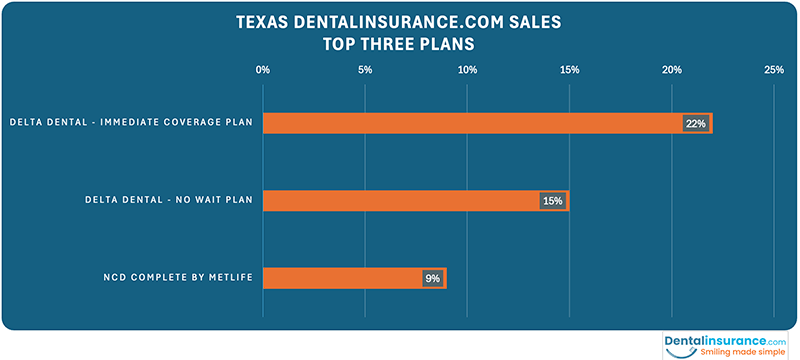

Below are the three most popular plans by sales in Texas through the DentalInsurance.com marketplace.

Top Plans by Coverage & Cost

Information in the table is based on a 32-year-old dental insurance applicant in Dallas, Texas. Plans may not be available in all areas.

Texas Dental Insurance Cost

Average Premiums & Plans Priced Under $10 a Month

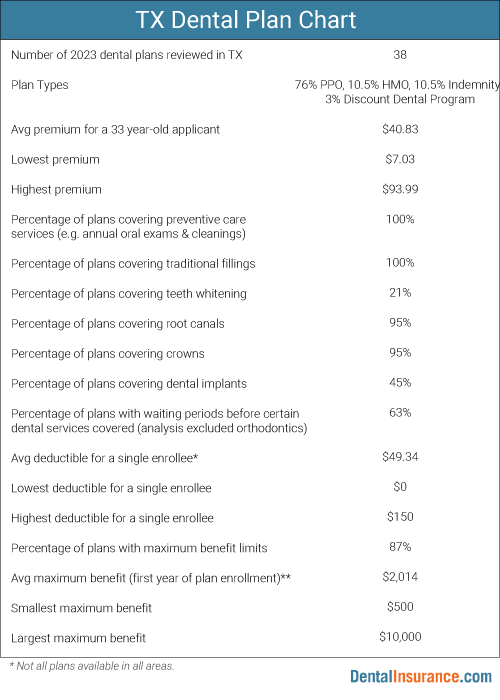

A review of 38 dental plans in the Lone Star State found a considerable range of prices. The average premium in 2022 was $40.83 for a 33 year-old sample applicant, but the lowest monthly premium was $7.03 for the MetLife TakeAlong Dental HMO-Managed Care 350 (Low). Every HMO dental insurance plan premium in the study fell below the state average as did the one dental discount program in the study (Careington 500 Series Dental Savings). Among PPO and indemnity dental plans, 16 out of 33 had premiums below the study average.

Out-of-Pocket Fees for Covered Dental Services

Two-thirds (69.2 percent) of the 39 plans covered routine dental cleanings without charging any copayment or other out-of-pocket fee. During the first year of enrollment, most of the plans covered root canals and crowns paid for 36.1 percent of the treatment cost. Several of the dental plans increased this coverage percentage for customers who stayed in the plan for two and three years in a row. For HMO plans whose out-of-pocket costs were flat-fee copayments, the price for a root canal ranged from $110 to $260, with a $192.50 average cost for the patient. The sole dental discount program, Careington 500 Series Dental Savings, had its root canal charge begin at $320.

Teeth extractions had higher coverage from PPO and indemnity plans than was the case for root canals and crowns, with insurer payments averaging 45 percent of cost. Insurer payments toward fillings were even higher, at a 62.4 percent of the procedure cost. HMO dental plans copayments for fillings ranged from $25 to $36.

43.6 percent of all plans in the study examined had some level of coverage for dental implants. Most of the plans with implant coverage paid for 50 percent of the procedure (assuming the deductible was satisfied). Three of the plans with implant coverage only provided for 20 percent of the treatment cost and one plan only covered 10 percent. 70.6 percent of dental plans that included implant coverage imposed a minimum enrollment length before their dental implant coverage became active. Such a delay in benefit access is known as a “waiting period.” Waiting periods were common (especially for more expensive dental care) among the 39 plans under consideration, with 33.3 percent having no waiting period delays for traditional dental coverage (orthodontics excluded).

All the PPO dental plans and indemnity dental plans had restrictions on how much money the insurance company would pay annually toward dental treatment. The average amount among these plans was $1,976. The NCD Nationwide 5000 Plan had a limit over two times higher than the average at $5,000, and the NCD Complete by MetLife, at $10,000, had a maximum benefit roughly five times the market average. Both the HMO plans and dental discount program in the study had no annual limits regarding insurer payments or customer savings.

These differences in insurer payment limits warrants some brief comments regarding different types of dental plans. A HMO is a dental health maintenance organization where care is covered when provided by in-network dentists and care outside the network is not covered. An indemnity plan, in contrast, does not limit the enrollee to specific dentists. However, an indemnity plan has a reimbursement scheme for dental services that may be lower than what a dentist charges. Within a HMO, the enrollee has fixed copayments (or, more rarely, coinsurance fees) that have been agreed upon by the dentists within the plan's network. Another form dental coverage is the dental preferred provider organization (PPO), the most common model of dental network, where in-network dentists have lower copays and cost-sharing than dentists who are out-of-network. In contrast, a HMO dental plan will normally not cover out-of-network dental care and their networks are typically smaller than is the case for PPO networks.

Deductibles

Out-of-pocket costs come in many forms: deductibles, flat fee copayments, and coinsurance fees (where the patient pays for a percentage of the dental service). A deductible is the money you pay your dentist before an insurance plan begins to share in covered dental treatment costs. If a policy has a $100 deductible then a patient pays the first $100 of dental care expenses during the coverage period (i.e. the plan year). After the deductible has been paid, the insurance company pays its portion of the dental service cost while the patient pays a copayment or coinsurance fee. When a new plan year begins, the process starts all over with respect to the deductible.

In Texas, deductibles varied, but within a relatively narrow range. The smallest deductible observed among the plans studied was $0. In fact, one-in-five plans examined charged no deductible ($0) to enrollees. The highest annual deductible for an individual was $100, though a single plan had a one-time individual deductible of $150. The average deductible for a single enrollee was $50 a year. Family deductibles were higher and often depended on the number of family members enrolled in the plan.

TX Dental Plans: Benefits & Coverage

Our review of over three dozen dental plans from across Texas found the following breakdown of plan types:

- 76 percent were preferred provider organizations (PPO)

- 10.5 percent were health maintenance organizations (HMO)

- 10.5 percent were indemnity dental plans

- 3 percent were discount dental plans

As is the case across the nation, preferred provider organization (PPO) dental plans are the most popular. They have the advantage of wide dentist networks and the flexibility to use dentists who are out-of-network. However, these plans have a maximum benefit, which is an annual limit on how much the insurance company will pay for dental care covered under the plan. If that limit is reached, the patient pays any additional costs fully out-of-pocket until the next plan year begins.

In the DentalInsurance.com marketplace, there is about one health maintenance organization (HMO) dental plan for every seven PPO plans. These HMO plans are very economical but have narrow dentist networks and do not cover out-of-network dentists. Indemnity plans have the greatest flexibility with respect to dentists since the plan sets a standard reimbursement for each covered dental service. However, this reimbursement can be lower than a dentist charges and the patient is responsible to pay any difference between the two amounts.

Only three percent of the marketplace’s options for Texas were discount plans. Discount plans, otherwise known as discount dental cards or discount dental programs, are not insurance. Instead, they are a membership program where enrollees enjoy mark downs (i.e. discounts) on the list cost of dental procedures. The advantages to discount plans are the lack of limits on procedures and no “waiting periods” delaying access to important care. The downside is an absence of free preventive services and the possibility of better negotiated rates for services among traditional dental insurance.

All the dental options – PPO, HMO, Indemnity, Discount Programs – have options that provide access to comprehensive dental services. Comprehensive dental services would include preventive care (e.g. annual cleanings and exams), basic care (e.g. fillings and extractions), and major care (e.g. root canals, crowns, and implants). Since dental benefits are not standardized, a consumer needs to review a plan’s benefit details to confirm its breadth of coverage.

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planEverything went smoothly

Everything went smoothly. The insurance plan was explained to me thoroughly and I believe I got the best deal for me.Timothy Kelly

The representative was so nice and…

The representative was so nice and understanding to my dental needs. I really appreciated how the representative researched the plans to best fit my need before purchase using suggestive selling techniques for the win.Denise Ficklin

Teeth Whitening

Teeth whitening is a form of cosmetic dentistry and most plans do not cover cosmetic dental services. However, a review of 39 Texas plans found that 20.5 percent had some form of coverage for teeth whitening. Many industry experts believe that teeth whitening coverage with become more common in the future.

Companies Providing Texas Dental Plans

The 39 plans reviewed as part of this study came from the following ten insurance companies: Ameritas, Careington, Delta Dental, Guardian Dental, Humana Dental, MetLife Dental, NCD by MetLife, and Renaissance Dental.

You're Ready to Compare Texas Dental Insurance Plans

Now that you’re more educated consumer regarding the Texas dental insurance market, you’re in a better position to judge the value of your dental insurance options in the Lone Star State. To review dental insurance prices in your region of Texas, you can visit our dental insurance quote page. You can also review below the most popular Texas dental insurance plans sold on DentalInsurance.com.

Need some help choosing a dental plan?

Our agents can:

- Answer your questions

- Confirm if your dentist is in-network

- Enroll you over the phone

Dental Plan Details chart in Texas for this Study

The following chart provides additional details on the coverage trend in our Texas dental plan study. You can use this information when evaluating the breadth of coverage provided in a dental plan you are considering for purchase. The chart helps you recognize when a plan’s feature (e.g. premium, maximum benefit, etc.) are above or below the averages for the state.

Oral Health Resources for Texas Residents

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Texas Dental Association (TDA)

Chartered in 1871, the TDA is the third largest state dental association in the United States. Currently, it has more than 9,000 members and is comprised of 26 dental societies grouped into 4 divisions across the state.

Texas Dental Resources

Helpful information regarding dental health, assistance for teaching children about proper oral health, dental emergencies, and one-minute videos on a variety of dental topics.

TDA Smiles Foundation

The Texas Dental Association sponsors the TDA Smiles Foundation, a program that expands access to dental health services to underserved communities in the state. The TDA Smiles Foundation accomplishes its work through several organizations including the Texas Mission of Mercy providing charitable dental care through dental clinic events across Texas, the Fluoride Fest and the Cavity Free Corral delivering oral health information to families, and SMART Smiles, which provides preventive dental services to elementary school aged children and low-income children.

Texas Dental Insurance News

April 23, 2025

Texas has a dentist shortage. Joining a compact with other states would help [Austin-American Statesman]

"Simply put, Texas does not have enough dentists and hygienists to meet current needs, let alone rising demand driven by population growth. Fortunately, the Legislature is considering a bipartisan solution that could bring swift relief: joining the Dentist and Dental Hygienist Compact (DDHC). Two companion bills filed in the Texas Legislature — Senate Bill 1109 and HB 1803 — would make Texas a member of this compact, enabling licensed dental professionals from other member states to practice in Texas without burdensome delays or redundant licensing hurdles.."

January 23, 2025

Credentialing Slowdowns Crippling Access to Care for Dental Medicaid [Texas Dentists for Medicaid Reform]

"Texas is grappling with a critical shortage of healthcare workers, including dental professionals, exacerbating dental access and provider issues across the state. A recent Newsweek article, “How Texas Could Solve Its Health Care Worker Crisis,” highlighted these problems, mentioning a Becker’s Dental Review article cited by TDMR that Texas has the lowest number of dental hygienists in the nation."

October 24, 2024

Woman claims fake dentist from Katy performed root canal, resulting in tremendous pain and months of suffering [KHOU 11]

"A Katy woman was arrested on Tuesday, Oct. 22, because Houston police say she's been posing as a dentist...According to court documents, Vivas performed a complex root canal on a woman even though she was not a licensed dentist or oral surgeon. At a court appearance, the judge said Vivas put the woman under anesthesia several times and left her in "excruciating pain."

February 22, 2024

While baby teeth will fall out, pediatric dental care is still crucial [UT Health]

“There is a perception by some that because baby teeth fall out anyway, why treat them?” said pediatric dentist Claudia I. Contreras, DDS, who is also an assistant professor at The University of Texas Health Science Center at San Antonio School of Dentistry. “This thinking is harmful because hygiene habits start in childhood. Learning proper manners, hand-washing, bathing and brushing teeth all start in childhood — washing between your toes is as synonymous as flossing between your teeth.”

Frequently Asked Questions

Do Texas Dental Plans Have Waiting Periods?

Two thirds of the 39 dental plans examined in Texas had waiting periods for one or more covered dental services. The waiting period length varied by plan and by specific services. The shortest waiting period was three months and the longest was eighteen months. Waiting periods are usually applied to more expensive services such as dental implants, root canals or crowns. These are known as major dental services. Waiting periods can also apply, though less frequently, on basic dental care such as fillings. It is unusual to see a waiting period on preventive care such as annual cleanings and dental exams.

Where can one learn more about the different types of insurance offered?

Dental Insurance 101 provides a solid introduction to dental insurance plans and their various features. Additionally, we have an article dedicated to the differences between PPO dental insurance and HMO dental insurance.

What is the annual maximum coverage amount for each plan?

A maximum coverage amount, otherwise known as a maximum benefit, is the dollar limit on insurance company spending for covered services within a plan year. Indemnity and PPO dental insurance have maximum coverage amounts while dental savings plans and HMO dental plans do not. Among the 39 Texas plans we examined, 87.2 percent had maximum coverage amounts, with the lowest being $500 annually and the largest $10,000. The average maximum amount per year was $1,976.

What are the plan types and coinsurance options for each plan?

The dental plan types examined in Texas were Preferred Provider Organizations (PPO), Health Maintenance Organizations (HMO), Dental Savings Programs, and plans that bundled dental plans with non-dental benefits such as vision and hearing care.

What are the age requirements for getting a dental insurance quote?

While people of any age can use our free dental insurance quoting service, you must be an adult to apply for a plan’s coverage. In some cases, an insurer may offer “child only” coverage where a dependent child is insured but in most cases at least one adult needs to be insured alongside children on a dental plan.

What does Texas dental insurance cost?

When examining 39 plans offered across the state of Texas, we found the average dental premium to be $40.15 a month for a 33-year-old applicant. Inasmuch as this was the average, there were many options less expensive and more expensive than this amount. The lowest monthly premium we observed for our applicant profile was $7.03 a month while the highest priced was $93.99.

What are the out-of-pocket costs for Texas dental insurance?

With respect to out-of-pocket costs, the average deductible for a single enrollee was $50 among 39 Texas dental plans examined. Most plans charged a deductible, though 20.5 percent of plans did not have a deductible. Family plans often charged a deductible per enrollee, though some capped the maximum deductible that may be charged a family regardless of enrollees.

HMO plans often charged fixed dollar copayments for covered dental treatments while PPO plans often used coinsurance fees which determined a patient’s out-of-pocket costs as a percentage of the service price.

Does a Dental Plan Have the Same Price in Every Region of Texas?

Not necessarily. There are local differences not only in the price of dentistry but there are also differences in dental service usage across the state. These regional differences means the same plan can have more expenses in one area versus another. An insurance company may decide to vary its rates by region because of this situation, though they may choose to have a single rate across the entire state.

Can I Use My Texas Dental Plan Out-of-State?

In some cases you may be able to do so. You would need to contact your insurance plan first and verify that an out-of-state dentist is in-network and then see if there are any conditions prohibiting your use of a dentist outside your state of residence.

If you are traveling outside of your country, it is unlikely that your plan will cover international care. If you do have a dental emergency while traveling overseas, contact your plan’s customer service team to understand your options.

I've Heard Someone Say Dental Insurance Isn’t Worth the Cost. Is that True?

Insurance may not always lower your costs because part of its value is to protect from large unanticipated expenses. This is the case whether you are discussing dental insurance or car insurance. However, with a dental plan the insurance company negotiates lower rates for procedures within its network of dentists. This can save considerable money off of the retail price of dental work.

What is a DHMO?

A DHMO is another name for a dental insurance health maintenance organization. A DHMO is a form of dental coverage where dental services are delivered through a network of dentists that is usually smaller than is the case for PPO dental plans. The DHMO dentists receive a fixed monthly fee per patient and then receive copayments from patients when they receive care. This type of arrangement is also referred to as a "capitation plan." HMO dental insurance is often the least expensive dental plan option and it has the further virtue of lacking a “maximum benefit.” A maximum benefit is an annual cap on how much an insurance company will pay toward patient care.