A Shopping Guide for NY Dental Plans

In this article

Struggling with inflation and want to lower your dental insurance costs? We've analyzed dozens of NY dental plans and have the data to help you find the best fit for your budget. This guide will help you quickly find the best plan for you. We provide consumers with:

A Brief Guide for Bargain Hunters

While you can’t get rebates or discounts on individual dental insurance plans, you can get more value based on benefits and the cost of a dental plan. Below are two graphics that offer a shortcut to which dental plans might be best for you.

|

Stop Researching & Start Shopping Dental Plans that Have What You Want |

|

| 3 Plans Covering Crowns | Anthem BlueCross BlueShield Essential Choice Incentive |

| Cigna Dental Vision Hearing 3500 | |

| Humana Extend 2500 | |

| 3 Plans Covering Implants | Humana Extend 5000 |

| Ameritas Dallas Smile Plan | |

| NCD Elite 3000 by MetLife | |

| 3 Plans Covering Braces for Children | MetLife TakeAlong Dental High |

| Anthem BlueCross BlueShield Essential Choice Platinum | |

| Delta Dental Dental for Everyone Platinum | |

| Highest Annual Maximum Benefit | ($10,000 annual maximum) NCD Complete by MetLife |

For more information on the above products as well as additional choices, go to our dental insurance comparison tool.

For more detailed information on the California dental insurance market, keep reading below.

Best New York Dental Insurance

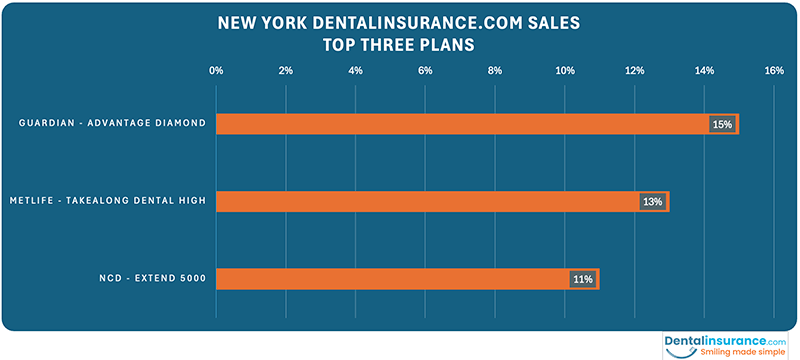

Below are the three most popular plans by sales in New York through the DentalInsurance.com marketplace.

Top Plans by Coverage & Cost

Information in the below table is based on a 32-year-old dental insurance applicant in Albany, New York. Plans may not be available in all areas.

Types of Dental Coverage

Before reviewing our findings on New York dental plans, it's important to clarify a few terms that we will use:

- PPO Dental Plan - A dental preferred provider organization is a dental insurance plan where an enrollee can use a dentist within the plan's network and benefit from lower out-of-pocket costs or use an out-of-network dentist and pay more for care

- HMO Dental Plan - A dental health maintenance organization normally has a narrow network of dentists and services received from out-of-network dentists won't be paid for by the dental plan. Specialized dental care also requires a referral unlike PPO plans where no referral is necessary

- Indemnity Plan - Indemnity dental plans typically reimburse an enrollee for only a share of the total cost of a covered dental service. Indemnity plans often do not restrict an enrollee to a network of dentists, thus providing more options for receiving dental care

- Dental Discount Program - A dental discount program is not insurance. Instead, it is a program where membership is accessed through a monthly fee and the enrollee can receive discounted dental care from dentists belonging to the discount program

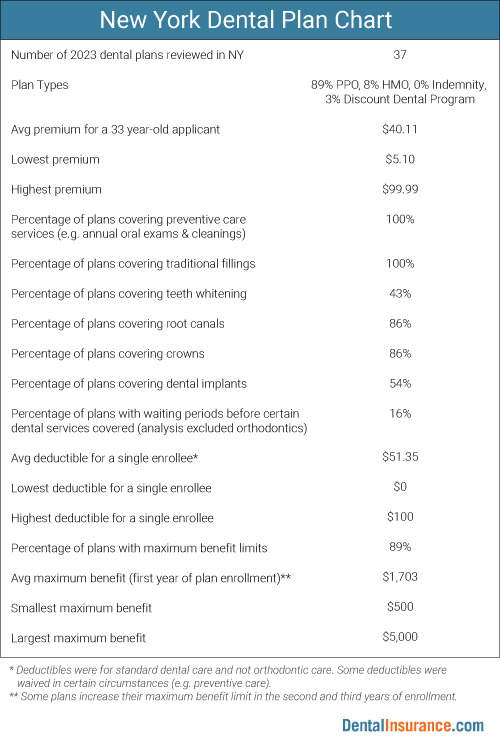

Premiums & Deductibles: Dental Insurance Doesn't Have to Be Expensive

Contrary to popular belief, quality dental coverage in the Empire State does not have to have a high price tag. Premiums (i.e. the monthly fee for dental coverage) in our study started as low as $5.10 (the MetLife TakeAlong Dental HMO-Managed Care 350 (Low)"). The average premium across 37 NY plans was $40.11 for a 33 year-old applicant. 18 of the 37 NY plans examined were below the premium average for the state. Three of these plans were HMOs, one a dental discount program, and the remaining 33 were PPO dental plans. The HMOs and discount program were among the most affordable plans but also had the most restrictive networks of dentists.

Since dental benefits are not standardized, it is extremely important to consider premium cost in light of what dental services are covered. For example, none of the three HMO plans reviewed covered dental implant treatments. These same plans offered orthodontic care, which is a dental benefit absent in many of the PPO dental plans. We also observed that none of the PPO plans whose premiums were below $22 a month covered major dental care such as root canals or crowns. Given these variations in coverage, it is essential for New Yorkers to review the Summary of Benefits (or Plan Details) for the options they are considering for purchase.

89.2 percent of the New York dental plans examined paid for regular teeth cleanings without any out-of-pocket costs for the enrollee. Filling expenses were covered at an average of 63.9 percent of total cost by PPO plans. The lowest coverage in the first year of PPO enrollment was 20 percent of filling cost and the best coverage was 80 percent. HMOs charged flat-fee copayments instead of coverage a percentage of costs, with the average cost being nearly $29 for a traditional filling. The HMO copayments ranged from $25 to $36. The charge for a filling under the dental discount program started at $80.

The ceiling on a plan's reimbursements for enrollee dental care is known as the plan's "maximum annual benefit." If a plan has a maximum annual benefit of $2,000, then any dental expenses beyond $2,000 in a single plan year would be the financial obligation of the enrollee, not the insurance company. The three HMO plans included in this study did not have a maximum annual benefit limitation, nor did the discount program have a limit on annual consumer savings. PPO plans, on the other hand, did have maximum benefits and they made up the majority of NY plan options within this study. The lowest of the maximum benefits was $500 per year. It is important to note that a single crown or dental implant has the potential to cost far in excess of this amount. Some plans had a maximum benefit that increased over time. For example, the Renaissance MAX Choice Plus had a maximum benefit of $1,000 in the first year of enrollment, $2,000 in the second, and $3,000 in the third and subsequent years of continuous enrollment. The average maximum benefit for plans having this spending cap was $1,703 (in the first year of coverage). The two plans with the highest maximum benefits both had a $5,000 cap on annual spending: The Humana Extend 5000 and the NCD Nationwide 5000 plan.

Deductibles did not vary among plans to the same degree as maximum benefits. Deductibles are the amount spent out-of-pocket by a dental plan enrollee before the plan begins sharing the cost of dental services. Some plans had no deductibles. This was the case for the three DHMOs included in the study as well as the dental discount program. For the plans charging deductibles, the highest amount for an individual was $100 annually. Family deductibles were higher and were often based on the number of family members covered by a policy (e.g. $50 per family member annually).The average deductible for a single enrollee among plans with deductibles was $51.35.

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planVery kind

Very kind, professional pick the right one for me that made me happyJudith

The insurance representative was…

The insurance representative was helpful and very understandingKirk Brooks

Major Services

Major dental services include care such as crowns and root canals. This can be very expensive care. For dental coverage of crowns where a flat fee was charged in 2023, a dental discount program within the study had the highest copayment ($701 for members of Careington's 500 Series Dental Savings Discount Card). HMO plans' crown copayment charges ranged from $245 to $430. 14 percent of the NY coverage options reviewed did not include crowns among their dental benefits. Most PPO dental plans contributed a percentage of the crown cost with the average being 49 percent of the total cost, the remaining 51 percent of the cost paid by the plan enrollee.

Root canal procedures had similar cost-sharing trends as found among crowns. Some plans didn't cover the care, others had flat fees between $110 and $399, and the rest had coinsurance payments. With respect to this coinsurance, the plans paid an average of 49 percent of the cost of the root canal.

How to Shop with Confidence

Armed with your knowledge from this article, it’s time to compare rate quotes for New York dental insurance. The following link will get dental insurance quotes in a matter of seconds. If you are interested in what your fellow New Yorkers are purchasing, below is a list of the bestselling New York dental plans on DentalInsurance.com.

Chart of NY Dental Plan Details for this Study

Frequently Asked Questions

Do I have to Buy Dental Insurance on the state’s health insurance exchange?

No. There are many dental plans offered off-exchange in the state of New York. This website allows you to compare premiums and benefits without obligation and, if you wish to purchase coverage, you can complete an enrollment form online in a matter of minutes.

Dental insurance purchased by consumers is sometimes called private dental insurance (because it is bought by a private person and not a company for its employees). Dental insurance can cover a single individual, or it can cover multiple related individuals in the form of family coverage.

Can I purchase a “kids only” dental plan?

This depends on the insurance company. Some companies do allow an adult to buy dental insurance for a child without insuring him- or herself. These policies are referred to as “kids only” or “child only.” Sometimes this type of insurance is sought by a non-custodial parent after a divorce.

Are dental plans compliant with the Affordable Care Act?

The Affordable Care Act is a law largely concerned with the regulation primary medical insurance. The law does, however, touch upon dental coverage. The ten Essential Health Benefits standardizing medical insurance coverage has requirements pertaining to dental coverage for children under the age of 18. This pediatric dental coverage can be part of the medical plan or supplemented through a stand-alone dental plan. Adult dental coverage, in contrast to pediatric, is not required of ACA-complaint medical plans.

What are some of the insurance companies that offer dental benefits in New York?

Given the number of consumers in the state, New York has many dental insurance companies from which to choose. Residents have the option of dental plans from MetLife, Cigna, Humana, Ameritas, Guardian, NCD, Renaissance, and Anthem.

What type of dental insurance plans are offered within this online dental insurance marketplace?

As of writing, 89.2 percent of the New York plans offered on this exchange are Preferred Provider Organization (PPO) dental plans. 8.1 percent are Health Maintenance Organizations (HMO). Dental discount programs represent 2.7 percent of the options.

Do I have to wait for an enrollment period to apply for dental insurance coverage?

No. Private dental insurance can be purchased at any time of the year. Usually it takes a few weeks before the paperwork is process and the coverage begins. During the application process, the system will display the date on which the insurance becomes effective for use.

How does New York Medicaid and CHIP provide dental coverage and to whom?

Medicaid is a health insurance program primarily serving populations with limited financial resources. New York’s Medicaid program is administered jointly by the federal government and the state of New York. Within its larger framework of health benefits, dental care coverage is provided for program enrollees. These enrollees can access their dental benefits through dental practices participating in the state’s fee-for-service program or through a Medicaid managed care plan. Program literature from the state of New York indicates that dental care received through the Medicaid program "shall include only ESSENTIAL SERVICES rather than comprehensive care."

New York provides child dental care both through its Medicaid program and also through its New York’s Children’s Health Insurance Program, which is know as “Child Health Plus.” Child Health Plus provides insurance coverage of various dental treatments including medically necessary orthodontia.

Can I buy dental insurance outside New York's health insurance exchange?

A health insurance exchange, also known as a marketplace, is a government-run store for health insurance options compliant with the Affordable Care Act (ACA). For children under the age of 18, an ACA health insurance plan must also include pediatric (i.e. child) dental coverage as part of the ACA’s Essential Health Benefits. The ACA does not require their health insurance plans to offer dental coverage for adults. Some ACA plans have dental benefits alongside their medical benefits and there are also stand-alone dental plans (SADPs) sold on the exchange. With respect to plans with embedded coverage, an enrollee might have to satisfy the medical deductible on the plan before the plan pays for dental benefits. Both health insurance plans with embedded dental benefits and SAPDs can be purchased from New York’s health insurance marketplace. Many of these options may also be purchased outside the marketplace as well.

Are stand-alone pediatric dental plans ACA-compliant and does it matter?

Stand-alone pediatric dental plans sold on a health insurance exchange must comply with the requirements of the Affordable Care Act (ACA). The specific pediatric dental benefits that an ACA dental plan must cover is determined in each state by the state’s benchmark plan. A benchmark plan is an insurance plan selected by a state and used as a guideline for the scope of insurance coverage.

The ACA prohibits annual and lifetime monetary limits on dental benefits as well as medical benefits. The ACA, however, does not require the coverage of braces unless it is medically necessary for a child (as opposed to contributing to an improvement in appearance). In 2025, the ACA caps the maximum out-of-pocket (MOOP) costs for pediatric dental care at $425 annually for the coverage of a single child. That annual limit is set to $850 if the plan covers multiple children.

Dental Resources for New Yorkers

We've pulled together information to help you find resources in your state to help you maintain your oral health.

New York State Dental Association (NYSDA)

The NYSDA represents 13,000 member dentists throughout New York State. This powerful partnership is enhanced by 13 local dental societies within the state of New York.

MouthHealthy: Oral Care Resources

The MouthHealthy.org website provides education (good oral health habits, top dental concerns, nutrition, etc.) categorized by age group and life stage (pregnancy, babies/children, teens, adults under the age of 40, adults ages 40 to 60, and adults over age 60.

Low-Cost New York Dental Care

The FreeDentalCare website lists free and low-cost dental services located in the state of New York. This site collects information on free dental clinics, sliding-scale clinics, low-cost clinics, and non-profit clinics. These resources may have limited capacity or eligibility criteria (e.g. income level).

New York Dental Insurance News

February 7, 2025

More than 30,000 wait for care as NY's dental crisis grows [Democrat & Chronicle]

"Tens of thousands of patients have spent months suffering on the growing wait list at Eastman Institute for Oral Health in Rochester, underscoring New York’s growing dental care crisis. Dr. Eli Eliav, director of the institute’s care network and school, could barely walk through one of its overcrowded dental office waiting areas one morning this past fall. At the time, its wait list included about 30,000 additional patients from across the state seeking dental care. Today, it's ballooned to over 32,000."

January 23, 2025

Flossing your teeth can put toxic chemicals in your body — what’s your risk and 3 brands that are safest [NY Post]

"Some flosses are healthier than others. One analysis found evidence of per- and polyfluoroalkyl substances (PFAS) in 13 of 39 brands. These “forever chemicals” make floss glide more easily between teeth, but they also persist in the body and nature. They’ve been linked to a range of health problems, including an increased risk of certain cancers."

October 7, 2024

Supplemental Medicare Advantage Benefits Still Leave Dental, Vision, and Hearing Care Out of Reach for Many Due to Out-of-Pocket Costs [NYU]

"Medicare Advantage plans offer a private insurance alternative to traditional Medicare coverage for health insurance. The most common supplemental benefits are dental, vision, and hearing, with more than 90 percent of Medicare Advantage plans providing coverage for one or more. These supplemental benefits, which are not available through traditional Medicare, are largely funded by rebate dollars paid by the Centers for Medicare and Medicaid Services (CMS) to the private insurers...An increasing number of low-income older adults are enrolling Medicare Advantage plans over traditional Medicare plans—a shift that may be driven by the supplemental benefits available in these plans. However, supplemental benefits may not provide full financial protection, as beneficiaries still face relatively high out-of-pocket costs and forego needed dental, vision, and hearing care."

March 10, 2024

Lawmakers consider solutions to New York dentist shortage [Spectrum News 1]

"As lawmakers weigh a series of bills to address a shortage of dental care across New York, dentists are hopeful, but skeptical, about how legislative proposals will fix a statewide multidimensional problem. Many rural and high-needs areas in the state have as few as one dental practitioner for every 4,000 people in many rural and high-needs areas, state health department data shows...A perfect storm of issues have created the state's oral health care crisis, including dentists retiring or closing, and new dentists leaving the state after they graduate – making it excessively difficult for low-income, elderly or disabled people to access needed dental care services."