Compare Plans and Buy the Best Value for your Dollar

In this article

If you’re a Michigander in need of dental insurance, this article will:

- Show you which plans on DentalInsurance.com are the bestsellers in Michigan based on DentalInsurance.com sales

- Provide an overview of dental plan costs in the state

- Review limits on dental plan expenses

- Help you find plans offered in your area of Michigan

- Summarize Michigan dental plan trends in an easy-to-read chart

What is the cost of Michigan dental insurance?

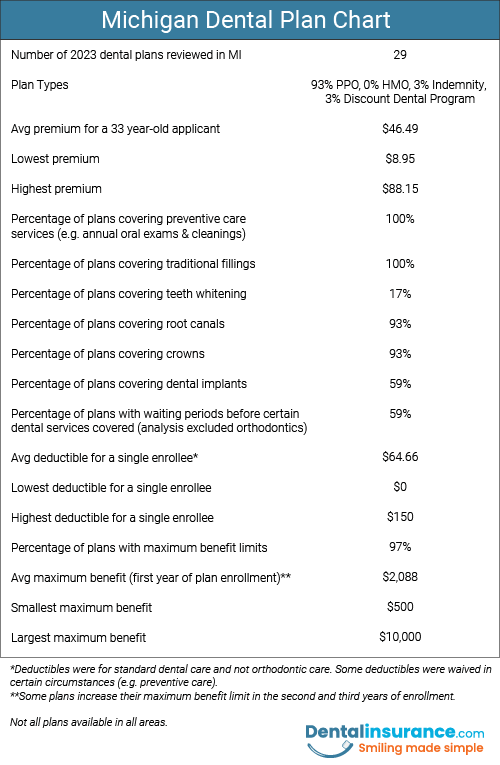

2024 continues a trend for competitive dental options in The Wolverine State. Last year’s review of 29 Michigan dental plans (offered by nine different brand name dental insurers) found a wide range of costs and benefits covered. The average premium among the offerings in the study was $46.49. The least expensive option for a 33 year-old applicant in Saginaw was the Careington discount dental program known as the 500 Series Dental Savings. This plan, in contrast to traditional insurance, offered members-only price reductions ranging from 20 percent to 60 percent within the network of dentists associated with the plan. The monthly cost for this option was $8.95 and there was no annual limit on the amount of dental services used or the total amount of savings.

What dental services does Michigan dental insurance cover?

93.1 percent of the Michigan plans in the study covered root canals and crowns, though many plans (59.3 percent) had waiting periods before this benefit was active. Coverage of dental implants was less frequent (58.6 percent) with waiting periods more common (70.6 percent). Many plans covered annual teeth cleanings with no additional out-of-pocket costs for this service within the very first year of enrollment. These plans included:

- MetLife TakeAlong Dental Medium PPO

- MetLife TakeAlong Dental High PPO

- Guardian Direct Advantage Starter PPO

- Guardian Direct Advantage Achiever PPO

- Guardian Direct Advantage Diamond PPO

- Humana Bright Plus PPO

- Humana Loyalty Plus PPO

- Humana Extend 2500

- Humana Extend 5000

- Ameritas Hollywood Smile Premier Plus 1500 PPO

- Ameritas Hollywood Smile Premier Plus 2000 PPO

- Ameritas Dallas Smile Plus PPO

- Renaissance Dental Plan III PPO

- Renaissance Dental Max Choice PPO

- Renaissance Dental Max Choice Plus PPO

- NCD Essentials by MetLife

- NCD Complete by MetLife

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planIt was great. Thank you for helping!

It was great.Terry Gross

Carlyn Rockett was such a help and a…

Carlyn Rockett was such a help and a pleasure to deal with. Thank you Carlyn!Jeffrey Wachhorst

What are the annual payment limits on covered dental care?

PPO and indemnity plans have an annual limit on the amount the insurance company will pay for enrollee dental care. This limit is known as the “maximum benefit.” When comparing the 25 Michigan PPO and indemnity plans belonging to our 2022 review, the average maximum benefit during the first year of enrollment was $2.087.50, a 31 percent increase from last year’s average of $1,588. The highest maximum benefit was $10,000 annually from NCD Complete by MetLife. Two plans tied for the second most generous maximum benefit. Both the Humana Extend 5000 and the NCD Nationwide 5000 Plan PPO had a $5,000 annual cap. Two plans were tied for the lowest limit ($500): Guardian Advantage Starter PPO and Guardian Advantage Core PPO. Some plans in the study increased their maximum benefits in the second and third year of continuous enrollment.

Deductibles ranged from $0 on the the discount dental card (Careington 500 Series Dental Savings) to a one-time $150 deductible for the PPO plan (Humana Loyalty Plus). The average deductible across the 29 plans reviewed was $64.66.

Finding Dental Plans in Your Area of Michigan

To compare dental insurance premiums in your region of Michigan, visit our home page. If you want to see which Michigan plans are most popular on DentalInsurance.com, see the below section.

Chart of Michigan Dental Plan Market Trends

Dental health resources for Michiganders

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Michigan Dental Association (MDA)

The MDA has over 5,900 members comprised of dentists and dental students.

SmileMichigan

SmileMichigan is a website that provides free oral health education and resources to residents of Michigan.

Free or Low-Cost Dental Care Providers

This webpage maintained by the Michigan Dental Association lists no-charge as well as reduced fee dental programs throughout the state.