Smile. We've got you covered.

Convenience and Flexibility

Convenience and Flexibility

Dominion National members have access to a robust dental network.

Save

Save

A choice of plan designs that work for YOU.

Here to Help

Here to Help

We offer exceptional service to best meet your needs.

Traditional dental insurance plans with HMO options

In this article

Here are some of the topics we will cover in this article:

- Intro to Dominion National

- Dominion National Dental Plans

- The bestselling Dominion plans on DentalInsurance.com

Introduction

Incorporated in 1996, Dominion National is a leading provider of dental and vision benefits in the mid-Atlantic market. Dominion National has over 900,000 customers spanning individuals and employer groups to associations and municipalities. The company offers managed care and indemnity programs, claims adjudication, and comprehensive plan administration. Among Dominion's thousands of customers are leading health plans, employer groups, municipalities, associations, and individuals.

Headquartered in Arlington, Virginia, Dominion National was selected by the U.S. Office of Personnel Management (OPM) as one of only 10 dental carriers to be offered through the Federal Employees Dental and Vision Insurance Program (FEDVIP). The FEDVIP provides benefits to federal employees, federal retirees, and their respective family members.

The Dominion National group of companies includes:

- Dominion Dental Services, Inc.

- Dominion USA, Inc. licensed issuers of dental plans

- Dominion Dental Services USA, Inc., a licensed administrator of dental and vision benefits

A Reputation Built on Trust

See why our Customers trust us to help them find the right Dominion Dental plaI thought it was very easy to do my…

I thought it was very easy to do my application over the phone.The person that help was nice 👍Erma Johnson

My representative was amazing and…

My representative was amazing and actually made my whole day. She was patient and helping me navigate different options. We had a relatable story that literally had me in goosebumps. Now every time I take my daughter to the dentist, I will think of shine. She helped me find the best fit for what I needed and what coverage I needed. I was highly satisfied.Yvonne Spotts

Dominion Dental Plans

Dominion National shoppers have three principal options from which to choose:

- “Select” plans

- Preferred Provider Organization (PPO) plans

- Discount Program

Select Plans

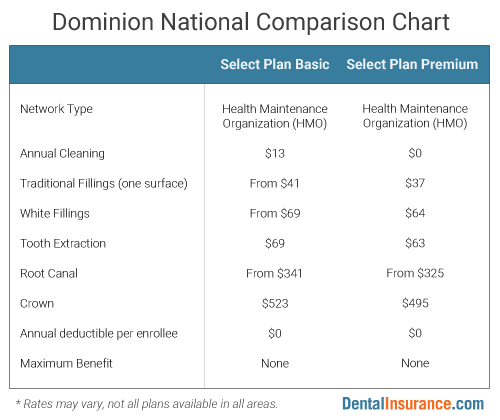

Select Plans (Select Plan Basic & Select Plan Premium) are managed care dental plans with a network of over 5,200 dental care providers. Managed care dental plans have similarities to HMOs in the world of health insurance. Typically out-of-network care is not covered by the plan. The Select Plans’ covered dental services have flat-fee copayments with no annual limits on spending by the dental plan. The Select Plans also have no waiting periods and no deductible.

Preferred Provider Organization (PPO)

A Dominion National PPO plan allows members to receive dental services from either an Elite PPO network dentist or any licensed dentist outside of this network. Out-of-pocket costs are normally lower for dental care received from a dentist inside the Elite PPO network. In fact, members may save up to 77 percent by using an in-network dentist. The Elite PPO network has over 9,000 dentists.

Discount Program

While dental discount programs are listed along with other dental insurance options, they are not the same. A Discount Program is not an insurance plan but, instead, a savings program where members can receive dental care at a reduced price from any of the dentists participating in the network for the Discount Program. Fees for extensive dental care may be reduced by up to 55 percent as compared to the usual and customary charges for those services.

More From DentalInsurance.com...

What is a PPO Dental Insurance Plan?

A dental PPO refers to a dental insurance plan whose network of dentists classifies them as a Preferred Provider Organization. In a Preferred Provider Organization, an enrollee will pay lower out-of-pocket dental insurance costs when using an in-network dentist. However, unlike a HMO dental plan, a PPO dental plan provides enrollees with the option of using an out-of-network dentist if they choose. This is true whether it is general dental care or a specialist such as an oral surgeon (so long as the plan benefits include the dental services received from the dentist).

Out-of-network dental care, though, does come with higher out-of-pocket costs than is the case for in-network dental care and this is one central trade-off when considering out-of-network care when enrolled in a PPO plan. However, higher out-of-pocket costs still may be more attractive than no coverage of out-of-network dentists, which is typical for HMO dental plans.

Like a PPO plan, an indemnity dental plan also has considerable flexibility around dentist choice but the plan will reimburse dental care at a customary and reasonable rate determined by the insurance company. However, since this rate is determined by the insurance company it may not correspond to what a dentist actually charges a patient. When the customary and reasonable rate is below the amount charged by a dentist, the patient is responsible to pay the difference between the two amounts.

Sometimes a dental Preferred Provider Organization is referred to as a DPPO instead of a PPO. Regardless of the two different acronyms, they refer to the same type of dental plan. For a more in-depth discussion of PPOs, see our resource on PPO dental insurance and Dental PPO Plans versus Dental HMO Plans.