A 2024 Shopper's Guide for Virginia Dental Plans

In this article

If you’re one of Virginia’s eight and a half million residents, you have the benefit of thousands of general and specialty dental practices. Virginians receive their dental coverage from a variety of sources ranging from privately purchased plans to employer plans to government insurance in the form of Medicaid or Medicare. This article reviews DentalInsurance.com’s latest research on the Virginia dental insurance market, including information on:

Our Best Virginia Dental Insurance Plans According to Sales

Using last year’s sales data from DentalInsurance.com customers, the three most popular Virginia dental plans were:

Virginia Dental Plan Costs

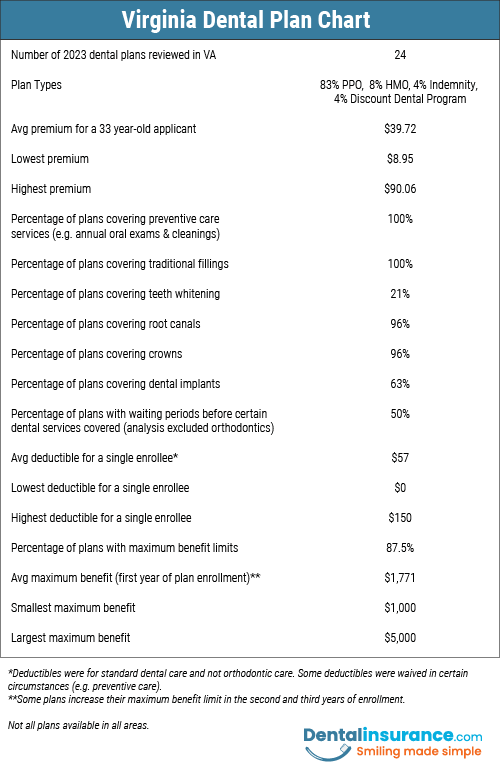

To provide some meaningful guidance to shoppers, DentalInsurance.com reviewed over two dozen dental plans offered in the State of Virginia. Price quotes were obtained for a hypothetical applicant who was 33 years old. The average monthly premium was $39.72 across all options (which included indemnity plans and a dental discount card alongside traditional PPO and HMO insurance), which is slightly more expensive than the average found for our 2022 study.

The least expensive option this year is the dental discount card offered by Careington (Careington 500 Series Dental Savings). It had a monthly fee of $12.95. Among traditional dental insurance, the least expensive PPO dental plan was Ameritas’ Hollywood Smile Premier 1500, which had a monthly premium of $21.79.

At the other end of the price range, the most expensive option among the reviewed plans was Renaissance Dental Max Choice Plus. This PPO plan had a monthly premium of $58.11 for a single 33 year-old in 2024.

In contrast to the prior year when three options had no deductible, only one plan, the Careington dental discount card, had no deductible. The traditional dental insurance plans all had deductibles, though one option had a deductible that only applied to the first year of enrollment and did not reset at the beginning of subsequent coverage periods.

State Averages Vs Prices Your Area

You can compare your local rates to these broader state trends. The following link will get dental insurance quotes for plans available in your zip code. You can also review the bestsellers listed earlier on this page, which are the most popular Virginia dental plans sold on DentalInsurance.com.

Maximum Benefit

The limit on insurer spending during a plan year, called the “maximum benefit,” varied considerably among the dental plans under examination. Among the PPO and indemnity plans that did have a maximum benefit, the average annual limit in the first year of coverage was $1,771 for 2023. In several cases, the maximum benefit was increased across multiple years of continuous enrollment. In 2024, the plans with the highest maximum benefit were the Ameritas Dallas Smile Plan and the Renaissance Dental Max Choice Plus, both with a $3,000 annual limit starting in the third year of enrollment. The lowest limit, tied among two HMO plans, was $0.

Dental Care Out-of-Pocket Costs

Even with dental coverage, a consumer should expect to pay out-of-pocket costs for dental care. Out-of-pocket expenses include the plan’s annual deductible, copayments, and coinsurance fees. For the 24 Virginia dental plans examined in 2023, fillings were covered by insurance at an average of 60 percent of the total cost, with the remaining 40 percent being the responsibility of the enrollee (HMO plans, in contrast, charged a fixed copayment amount rather than covering a percentage of the cost). This 60 percent average represents a slight improvement in cost-sharing as compared to the average for 2022 (59 percent). Root canals and crowns had lower contributions from insurance companies at 37 percent of the total cost, though over a third of the plans increased their contributions for loyal customers who stayed enrolled for a second and third year of continuous coverage. One Virginia plan, Anthem BlueCross BlueShield’s Essential Choice Bronze, did not have any coverage for crown or root canal procedures, though Anthem’s other plans in the study (such as the Essential Choice Gold and the Essential Choice Incentive) did cover these treatments.

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planvery knowledgeable rep-walked me thru…

very knowledgeable rep-walked me thru all aspects of policy-an easy and pleasant experienceMadisyn Brower

Freeda great to work with

Freeda great to work with. Very professional!Deb Bright

Types of Privately Purchased Coverage

The main types of dental coverage purchased by consumers are individual and family coverage.

Individual Dental Coverage

Individual dental insurance refers to a dental policy purchased by a single individual. This type of dental coverage is contrasted to group dental insurance where an employer, union, or other organization purchases a dental policy to cover many people belonging to the organization. The state of Virginia has many insurance companies who offer dental coverage within the individual dental insurance market. Examples include Humana, Ameritas, MetLife, Renaissance, and Anthem BlueCross BlueShield.

Need some help choosing a dental plan?

Our agents can:

- Answer your questions

- Confirm if your dentist is in-network

- Enroll you over the phone

Family Dental Coverage

Family dental insurance is distinguished from individual and group dental insurance by several characteristics:

- While family coverage is purchased by a private citizen as is the case for individual coverage, it covers multiple enrollees

- While family coverage insures multiple enrollees like a group dental insurance, the relationship among the individuals must be relatives, not a shared employer or professional association

When applying for family insurance, an insurer requires that the applicant provide information (e.g. date of birth) on each family member who will be covered by the plan. Deductibles are normally higher for family coverage. Some plans charge a deductible (e.g. $50) per family member on the plan. In some cases, the maximum deductible a family can pay is capped (e.g. $150 per year).

State Averages Vs Prices In Your Area

With the information provided in this study, you can compare your local rates to larger state trends. The following link will get dental insurance quotes for plans available in your zip code. You can also review the bestsellers below, which are the top-selling Virginia dental plans on DentalInsurance.com.

Chart of VA Dental Plan Details for this Study

Chart of Virginia Dental Plan Information

Oral health resources for Virginia Residents

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Virginia Dental Health Resources

This page sponsored by Teeth Wisdom contains links to Virginia-oriented websites on oral health and where to find affordable providers of dental care.

Virginia Dental Association (VDA)

Begun in 1870 as the Virginia State Dental Association, the VDA has grown from its original nine members one hundred and fifty years ago to thousands today. The VDA has multiple objectives spanning dental professional advocacy to promoting best practices within the field of dentistry and providing professional development/continuing education to its members.

Virginia Department of Health Professionals

This page hosted by the State of Virginia provides consumers with resources to look up information on dentists (e.g. licensure), find COVID information regarding dental care, as well as file a complaint.

Low-Cost Dental Care for Virginians

This resource from the Virginia Dental Association lists free and low cost dental options in the state. They include The VDA Foundation, Missions of Mercy, and donated dental services.

Frequently Asked Questions (FAQ)

Are Virginia dental prices fixed by law?

Dental prices are not legislated but insurance companies must submit them to the State of Virginia for approval. The approved rate of a stand-alone dental plan stays the same regardless of which agent or broker sells the plan. The rate that the insurance company submitted for approval reflects the competition in the area as well as factors such as the cost of dentists in the region and the local rates for dental care utilization. Other factors that influence monthly insurance premiums are the number of people insured under a policy (e.g. single coverage or family). The type of provider network can also affect pricing. PPO plans, which have larger dentist networks, typically have higher prices than HMO plans with comparable benefits.

How does DentalInsurance.com help consumers pick the right plan?

DentalInsurance.com provides free education materials that address the major issues surrounding the purchase of dental insurance. These issues not only include comparing values of different plans but understanding specific issues around the waiting periods, maximum benefits, and out-of-pocket costs. Additional articles are devoted to specialty care and procedures such as cosmetic dentistry, implants, crowns, and root canals. Another useful set of resources concern choosing a dentist, recognizing a bad dentist, resolving a dispute over poor dental care, and winning an insurance appeal. To review these materials, visit our Learning Center.

DentalInsurance.com also monitors its own customer performance. On the home page of the website, you can see the company’s TrustPilot ratings and drill down on testimonies from actual customers.