2025 GA dental plans and lowest available rates

What's in this guide

This 2025 Georgia dental insurance guide will provide the information you need to find the best dental insurance for your needs. Our resource includes:

- An overview of dental insurance prices in the Peach State

- An analysis of deductibles

- A list of the bestselling Georgia dental plans on DentalInsurance.com

- A chart providing cost and benefit trends among Georgia plans to help with comparison shopping

Best Dental Insurance in Georgia

Top Plans by Coverage & Cost

Information in the table is based on a 32-year-old dental insurance applicant in Marietta, Georgia.

Plans may not be available in all areas.

GA Dental Plan Costs

A review of dental plans offered in Georgia in 2025 revealed a variety of interesting characteristics. Together these plans had an average monthly premium of $48.45 (based on a 32 year-old sample applicant residing in the state).

The lowest premium along the plans examined was $12.95 a month for a dental discount program, the Careington 500 Series Dental Savings. This is a program where members pay a monthly fee to gain access to a dental network that offers care at reduced cost. The most expensive plan was the Humana Extend 5000, that supplemented hearing and vision coverage to traditional dental at a combined cost of $99.99 a month.

All eighteen plans in the study covered annual teeth cleaning as well as traditional fillings and tooth extraction. 44 percent of the plans surveyed also covered teeth whitening. With respect to more expensive dental treatments, 78 percent of plans had some level of coverage for dental implants, with that percentage rising to 94 percent for crowns. Many of the insurance companies had delays before expensive dental services were covered. These delays are known as waiting periods.

94 percent of the plans examined had an annual limit on how much the plan would pay for covered dental care. This cap is referred to as a maximum benefit. Among the forty Georgia plans that had a maximum benefit, the average annual payment limit was $2,721. The most generous of these limits was $10,000, offered by NCD Complete by MetLife.

Deductibles

The average deductible for a individual was $51.00. Deductibles for single enrollees grouped as follows with respect to the forty Georgia dental plans under examination:

| Deductible Amount* | Number of Plans in Study | Percentage of Plans in Study |

| $0 | 5 | 12.8% |

| $25 | 1 | 2.5% |

| $50 | 26 | 65% |

| $75 | 3 | 7.5% |

| $100 | 5 | 12.5% |

| * Deductibles may have restrictions | ||

87.5 percent of the plans had a deductible that increased for every person added to the policy.

It is important to note that in some cases a deductible might be waived for preventive services or may have a deductible that was paid once during the entire time of enrollment, even if enrollment is several years. Some plans with orthodontic coverage had an additional separate deductible that applied to those services.

Family Deductibles

Deductibles for families were higher than for individuals. 12.5 percent of plans in the study had no deductible. As noted earlier, most plans had a deductible amount that increased for every additional person on the policy. Over half of the plans (52.5 percent) had a maximum deductible for families (e.g. no more than three $50 deductibles per family).

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planCarlynn was very knowledgeable

Carlynn was very knowledgeable, patient, helpful. She, also, researched my question and came back with an answer.Marysabel Sanchez-Moore

Agent Knowledgable.

Agent Knowledgable.Erika

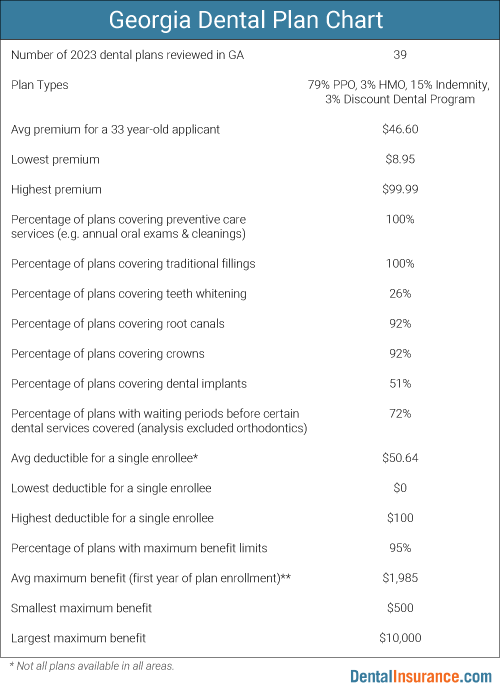

Chart of Georgia Dental Plan Details for this Study

Interested in knowing whether the plan you're considering is above or below average? We've assembled some data below to help you with your comparisons.

Oral Health Resources for Georgians

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Georgia Dental Association (GDA)

The Georgia Dental Association is the "premier professional organization" of Georgia dentists. Its mission is to enhance local oral health and promote professional excellence through a combination of education, advocacy, and professionalism.

Georgia’s Program for Oral Health

The state Department of Public Health (DPH) has dental services for the prevention and treatment of oral problems. Care includes exams, cleanings, fillings, and more. For detailed information and who qualifies, see the Oral Health Program for Georgia. Information about which dental services are covered by the program, as well as clinic hours and locations, can be found at the Georgia Oral Health Coalition.

Free and Reduced-Cost Dental Clinics

This online resource provides a document listing charitable clinics located throughout the state of Georgia. The Georgia Dental Association also has another webpage for donated dental services. This program provides free, comprehensive dental care to people who have disabilities or who are elderly or who are medically fragile.