We Offer the Lowest Available Rates on our PPO, HMO, and Indemnity Plans

In this article

With over 20 million residents and more than 12,000 dentists, Florida is one of the largest markets for dental coverage in the nation. Florida dental plans differ by benefits, covered dentist, and price. This guide will help you quickly find the best plan for you. We provide consumers with:

A Brief Guide for Bargain Hunters

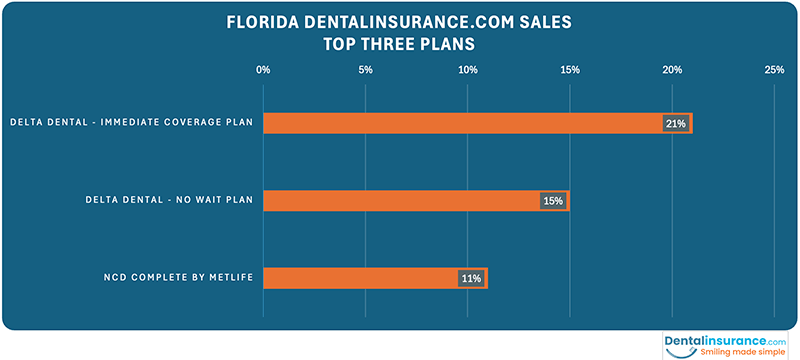

While you can’t get rebates or discounts on individual dental insurance plans, you can get more value based on benefits and the cost of a dental plan. Below are two graphics that offer a shortcut to which dental plans might be best for you.

|

Stop Researching & Start Shopping Dental Plans that Have What You Want |

|

| 3 Plans Covering Crowns | Delta Dental - Dental for Everyone Platinum |

| Humana Extend 5000 | |

| MetLife TakeAlong Dental Medium | |

| 3 Plans Covering Implants | Cigna Dental Vision Hearing 3500 |

| Guardian Advantage Premier | |

| Renaissance Dental Plan III | |

| 3 Plans Covering Braces for Children | Delta Dental - Dental for Everyone Platinum |

| Guardian Advantage Diamond | |

| Renaissance Dental Max Choice | |

| Highest Annual Maximum Benefit | ($10,000 annual maximum) NCD Complete by MetLife |

For more information on the above products as well as additional choices, go to our dental insurance comparison tool.

For more detailed information on the California dental insurance market, keep reading below.

Best Florida Dental Insurance Plans

What makes a dental plan the best? We give you several ways to decide. Here are the best-selling dental plans for our customers in Florida based on a 12-month analysis. Below these plans are additional plans who excel in one or more aspects of dental coverage.

Top Plans by Coverage & Cost

Information in the table is based on a 32-year-old dental insurance applicant in Jacksonville, Florida. Plans may not be available in all areas.

Average Dental Premiums & Out-of-Pocket Costs

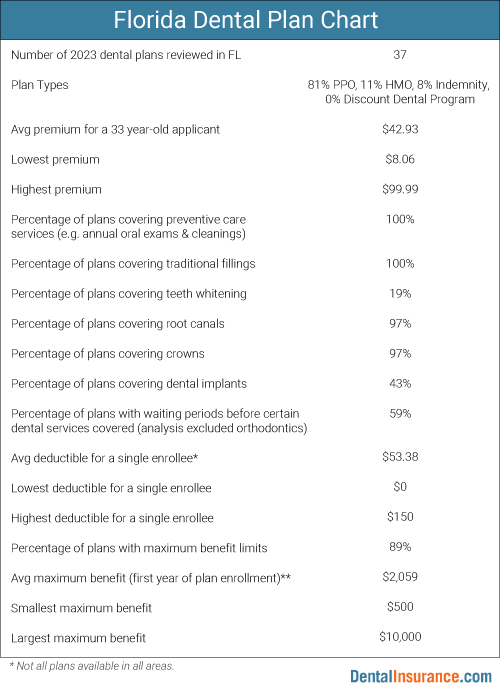

The large number of residents and dentists encourages rigorous competition in the Florida dental insurance market. An analysis of 38 Florida dental plans for 2023 found the average monthly premium for a 33 year-old enrollee was $42.26. This average was a little more than 2 percent higher than the average DentalInsurance.com observed for 2022 (though the 2022 study had 3 fewer plans). A similar study on California dental insurance found the 2023 average premium approximately 5 percent higher than was the case for Florida. The Humana Extend 5000 had the highest premium at $99.99 a month, but it also had a maximum benefit twice the average amount of the other PPO and indemnity plans examined. The lowest cost option among traditional dental insurance was a HMO plan, the Guardian Managed DentalGuard, cost $8.06 a month.

The average premium was derived from 38 plans offered by eight insurance companies: Ameritas, Delta Dental, Guardian, Humana, MetLife, Nationwide, NCD, and Renaissance.

Deductibles, the amount paid out-of-pocket by a plan enrollee before the plan begins to contribute to dental costs, ranged from a low of $0 to a high of $150 for an individual. The average deductible for a single enrollee was $53.95, down from 2022’s $65, and 18.4 percent of plans had no deductible. Several plans capped family deductibles at a total of $150 annually. The highest capped deductible for a family was $450 but this plan charged the deductible only once no matter how many years the family stayed continuously enroll in the plan. Some plans did not have a cap on the family deductible amount and charged $50 per enrollee.

Comparing Plans

Common dental work such as crowns also had a broad range of costs across the plans reviewed. Two plans had no coverage for crowns. Given the high expense of crowns ($500 to $2,000), consumers should weigh the pros and cons carefully before enrolling in such a plan. HMO plans usually charge flat fees for crowns. Their average copayment in the Florida study was $358.75. The least expensive copayment was $245 and the most expensive was $430. Indemnity and PPO dental plans contributed a percentage of the crown cost, leaving the remaining expense to be paid by the enrollee. The average percentage paid (by a PPO or indemnity plan) toward the total cost of a crown was 30.3 percent in the first year of insurance coverage. Several plans increased their contribution toward crown costs in the second and third year of continuous coverage.

PPO and indemnity contributions toward fillings were higher than was the case for crowns. On average, those plans covered 61.5 percent of traditional filling costs in the first year of coverage. Teeth extraction coverage was not quite as high, averaging 42.4 percent of the total cost.

Many dental plans in Florida had a waiting period attached to some of the services covered by the plan. A waiting period is a delay before the plan will pay for a certain dental procedure. The length of a waiting period is often 3-months to a year, and it is measured starting from the date the plan becomes active for the enrollee. Of the 38 Florida dental plans reviewed, 39.5 percent did not have a waiting period for any standard dental benefits they provided (orthodontics, which is not standard among traditional dental insurance, was not considered).

Most of the Florida dental plans in this study had an annual limit restricting what an insurance company will pay for covered dental care. This limit is called the maximum benefit. The HMO dental plans in the study had no such limit but among the remainder of the plans, the average maximum was $2,021. This was considerably higher than the previous year’s average of $1,640. This year had the benefit of two new plans: the Humana Extend 5000 with a $5,000 maximum, and the NCD Complete by MetLife with a $10,000 maximum benefit.

Cosmetic dentistry is often excluded from traditional dental coverage. These services include teeth whiting and veneers. DentalInsurance.com found 18.4 percent of our Florida dental plans included teeth whitening among their benefits.

Local Prices Vs State Averages

You can compare prices and out-of-pocket costs in your area to the averages mentioned above by visiting our dental insurance quote page. We have prices for plans in Miami, Jacksonville, Tampa, Orlando, and everywhere in between.

Cheapest Dental Insurance

Shopping on premium alone is risky business because dental plans have different levels of dental service coverage. However, for shoppers who need to know what the cheapest dental plans are, the lowest DentalInsurance.com offer in the state of Florida include:

- Guardian Managed DentalGuard (HMO) $8.06

- MetLife TakeAlong Dental HMO-Managed Care 350 (Low) (HMO) $8.20

- Humana Dental Value Plan HI215 (HMO) $11.99

- MetLife TakeAlong Dental HMO-Managed Care 245 (High) (HMO) $13.17

- MetLife TakeAlong Dental Low (PPO) $17.55

- Ameritas Hollywood Smile Premier 1500 (PPO) $18.74

The above monthly premium estimates assume a 33 year-old resident of Florida.

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planHelpful in selection of a dental plan…

Helpful in selection of a dental plan fit for me and my spouse within 15 minutes.Kyle Vivio

I could understand the clearly spoken…

I could understand the clearly spoken English! They knew what I needed to fix my issues. Very friendly and fixed what I needed!Henry Montoya Jr

Florida Dental Insurance: Networks

Florida has a variety of options regarding the dentists who can be used in conjunction with a dental plan. HMOs have the most restrictive networks and account for 10.5 percent of the Florida plans examined for this study. PPOs, in contrast, represented the majority of dental plans at 81.6 percent and often provide wider dentist options. Indemnity plans, which typically do not restrict dentist choice, represented 7.9 percent of plans.

If you have a preferred dentist you want to continue using for your dental care, confirm that they are in-network with a dental plan before enrolling. You may even want to call the dentist's office to confirm because sometimes dental provider directories at an insurance company are out of date with respect to insurance acceptance.

Care received from an out-of-network dentist for your dental plan can lead to higher out-of-pocket expenses. A plan may choose not to reimburse for out-of-network service (e.g. this may happen with a HMO) or may reimburse at a rate the dentist sees as too low, resulting in "balance billing" where you are responsible not just for your normal copay but the difference between what the dentist charges for a service and what the plan paid.

Miami and Jacksonville Dental Insurance

Jacksonville, while not as well-known internationally as Miami, is actually the larger of the two cities in Florida with almost a million residents. Miami has about half that population. Together these cities boast a dental insurance market with over thirty options listed on this website. Because of regional differences in dentist costs and dental service usage, you’ll notice that some plans have different prices in Jacksonville versus Miami.

| Plan Name | Network Type | Maximum Benefit | Jacksonville* | Miami* |

| Ameritas Dallas Smile Plus | PPO | $2,000 - $3,500 | $55.26 | |

| Ameritas Hollywood Smile Advantage | PPO | $1,500 | $34.82 | |

| Ameritas Hollywood Smile Elite | PPO | $2,500 | $44.41 | |

| Cigna Dental 1500 | PPO | $1,500 | $37.00 | $41.00 |

| Cigna Dental Vision Hearing 3500 | PPO +Vision +Hearing |

$2,500 | $58.54 | $68.69 |

| Delta Dental Dental for Everyone Gold | PPO | $1,000 | $42.10 | $38.51 |

| Delta Dental Dental for Everyone Immediate Coverage | PPO | $3,000 | $72.01 | $66.82 |

| Delta Dental Dental for Everyone No Wait | PPO | $2,000 | $54.77 | $49.93 |

| Delta Dental Dental for Everyone Platinum | PPO | $2,500 | $56.69 | $51.65 |

| Guardian Advantage Core | PPO | $500-$1,000 | $24.09 | $24.09 |

| Guardian Advantage Diamond | PPO | $1,500 | $43.29 | $43.29 |

| Guardian Advantage Achiever | PPO | $1,000 - $1,500 | $34.47 | $34.47 |

| Guardian Advantage Premier | PPO | $3,000 | $53.25 | $53.25 |

| Guardian Managed DentalGuard | HMO | N/A | $8.06 | $8.06 |

| Humana Bright Plus | PPO | $1,250 | $23.99 | $23.99 |

| Humana Extend 2500 | PPO +Vision +Hearing |

$2,500 | $67.99 | $67.99 |

| Humana Extend 5000 | PPO +Vision +Hearing |

$5,000 | $99.99 | $99.99 |

| Humana Loyalty Plus | PPO | $1,000 - $1,500 | $35.99 | $35.99 |

| Humana Dental Value Plan HI215 | HMO | N/A | $11.99 | $11.99 |

| MetLife TakeAlong Dental HMO-Managed Care 245 (High) | HMO | N/A | $15.25 | $15.25 |

| MetLife TakeAlong Dental HMO-Managed Care 350 (Low) | HMO | N/A | $8.20 | $8.20 |

| MetLife TakeAlong Dental Medium | PPO | $1,500 | $38.37 | $42.58 |

| MetLife TakeAlong Dental High | PPO | $2,000 | $45.26 | $50.07 |

| NCD Complete by MetLife | PPO | $10,000 | $83.00 | $91.00 |

| NCD Elite 3000 by MetLife | PPO | $3,000 | $69.00 | $72.00 |

| NCD Elite 5000 by MetLife | PPO | $5,000 | $79.00 | $82.00 |

| NCD Essentials by MetLife | PPO | $2,000 | $62.00 | $72.00 |

| Renaissance Dental Max Choice | PPO | $1,200 | $42.29 | $52.54 |

| Renaissance Dental Max Choice Plus | PPO | $1,000 - $3,000 | $64.58 | $79.72 |

| Renaissance Dental Plan II | PPO | $1,000 | $32.29 | $32.29 |

| Renaissance Dental Plan III | PPO | $1,000 | $41.44 | $41.44 |

*Estimated Premium is for a 32 year-old applicant. |

||||

Seniors & Dental Coverage

Florida is famous for being a retirement destination for senior citizens. In fact, according to the Population Reference Bureau, only the state of Maine has a higher percentage of senior citizens than Florida. Over one-in-five Florida residents are age 65 or older. This population is typically eligible for Medicare but Original Medicare (i.e. Parts A & B) does not include dental care among its medical benefits. As such, senior Floridians often look for a stand-alone dental plan or a Medicare insurance that includes dental benefits.

Need some help choosing a dental plan?

Our agents can:

- Answer your questions

- Confirm if your dentist is in-network

- Enroll you over the phone

Chart of Florida Dental Plan Details for this Study

Oral Health in Florida

The State of Florida has 14,000 practicing dentists and 30,000 dental team members serving the state's population of 21,000,000. This means there is a ratio of 1,500 residents for every one dentist. With respect to children’s oral health, the 2016 report "Florida’s Burden of Oral Disease Surveillance Report" noted that "the majority of children in Florida (68.9%) have teeth that are in excellent or very good condition. This prevalence is similar to the national average." With respect to the elderly, Florida has one of the highest senior populations in the United States. Dental care is a major concern for the elderly population because:

- Most seniors are retired and lack access to an employer dental plan

- Original Medicare does not include dental benefits

- Many seniors take medications that reduce saliva production and increase the probability of tooth decay

Charitable Care

Florida has several programs providing charitable dental care. For example, the Florida Mission of Mercy holds a two-day event where free dental services are provided to 2,000 low-income Floridians on a first-come-first-serve basis. "Project: Dental Care" is a program delivering dental services across the state to people who do not qualify for public assistance but are still in great need of dental care. The program targets lower income Floridians underserved by traditional avenues of dental care.

Frequently Asked Questions on Florida Dental Insurance

What Are The Premiums and Copays Associated with Florida Dental Plans?

A review of 38 plans available to Florida residents found the average premium for a 33-year-old was $42.26. Copayments varied and were most common among HMO plans. PPO dental plans, in contrast, were more likely to charge a coinsurance fee for covered dental services. A coinsurance fee is a percentage of the service’s total cost which is paid by the dental plan enrollee.

What Are Different Types of Dental Plans Offered in Florida?

Of the 38 Florida dental plans reviewed, 81 percent were Preferred Provider Organizations (PPO). PPO are the most common dental plan and have flexible rules around dentist choice. 11 percent of the plans were Health Maintenance Organizations (HMO) with restrictive networks. The remaining eight percent of the plans were indemnity plans. An indemnity plan is a fee-for-service dental plan reimbursing the plan holder for a portion of covered dental care. The reimbursement amount is not dependent on what a dentist actually charges but, rather, the indemnity plan's own determination of "usual, customary and reasonable" fees.

Are There Any Waiting Periods for Coverage under Florida Dental Insurance?

There are waiting periods for some services within many Florida plans. 61 percent of the 38 plans reviewed had a waiting period for at least one dental service. The shortest waiting period required among these plans was three months of continuous enrollment before a specific benefit was covered and the longest waiting period was 12 months.

How Can a Person View Plans and Prices Available In His or Her Region of Florida?

Click the “Find Plans” button and enter your zip code and birthdate. If you have additional family members, you’ll need to add their birthdates by clicking either the Add Spouse or Add Child button. After that, you can review the locally available options by clicking the See Plans button.

What Are the Names of Dental Plans Available in Florida?

Florida dental insurance options include: Ameritas Dallas Smile Plus, Ameritas Hollywood Smile Elite, Ameritas Hollywood Smile Advantage, Delta Dental Dental for Everyone Diamond, Delta Dental Dental for Everyone Diamond Premier, Delta Dental Dental for Everyone Gold, Delta Dental Dental for Everyone Gold Premier, Delta Dental Dental for Everyone Platinum, Delta Dental Dental for Everyone Platinum Premier, Delta Dental Immediate Coverage Plan, Guardian Advantage Achiever, Guardian Advantage Core, Guardian Advantage Diamond, Guardian Managed DentalGuard, Humana Bright Plus, Humana Dental Value Plan HI215, Humana Extend 2500, Humana Extend 5000, Humana Loyalty Plus, MetLife TakeAlong Dental High, MetLife TakeAlong Dental HMO-Managed Care 245 (High), MetLife TakeAlong Dental HMO-Managed Care 350 (Low), MetLife TakeAlong Dental Low, MetLife TakeAlong Dental Medium, Renaissance MAX Choice, Renaissance MAX Choice Plus, Renaissance Plan II, Renaissance Plan III, NCD by MetLife, NCD Complete by MetLife, NCD by MetLife, and NCD Essentials by MetLife.

What Are The Coinsurance Options For The Various Florida Plans?

Coinsurance fees for more common on indemnity and PPO plans than HMO plans. The average coinsurance charge for a filling was 38.5 percent of the filling cost. Root canals average 69.7 percent of the procedure’s cost during the first year of enrollment (though some plans reduced the cost during the second and third year of continuous enrollment). The average coinsurance fee for a dental implant (i.e. an artificial tooth) was 58.1 percent of cost during the first year of enrollment.

More Oral Health Resources for Florida Residents

We've pulled together information to help you find resources in your state to help you maintain your oral health.

Florida Dental Association (FDA)

Since 1884, the Florida Dental Association (a statewide professional membership organization representing Florida-licensed dentists) has worked to ensure that patients receive the highest quality care from dental professionals practicing in the state.

Florida's Action for Dental Health

This resource provided by the Florida Dental Association promotes and advocates for oral health among all Floridians.

Central Florida District Dental Association

This resource includes discussion of a wide variety of dental topics on dental needs according to life stage as well as answers to your general dental questions.

Low Cost Dental Clinics in Florida

This resource lists free and low-cost dental services available in Florida, including free dental clinics, sliding fee scale dental clinics, and non-profit dental clinics.

Florida Dental Insurance News

February 18, 2025

New bill would allow 'dental therapists' to fill shortage of dentists in Florida [WTSP.com]

"State Representative Linda Chaney said more than 1,000 dentists are needed here in Florida. She's proposing a bill that would create a new profession that could help address that void. This new role called a "dental therapist" would be considered a mid-level dental care profession. “They are trained to provide a scope of services between that of a dental hygienist and a dentist and may only provide those services under the supervision of a licensed dentist,” Rep. Chaney said."

April 3, 2025

Last in the nation: Florida’s dental care crisis (Click Orlando)

“Sixty-six of Florida’s 67 counties lack sufficient dental professionals and almost half of the state’s population does not have dental insurance.”

January 9, 2025

'It was horrific': Patient in $11M dental fraud scheme says he still hasn't recovered [WPBF News]

"More charges may be coming against a South Florida woman, her husband and a dentist, all involved in what investigators say was a massive $11 million dental insurance fraud going back more than a decade. It looked like a regular dentist's office in Boynton Beach, but former patient Jason Tuszynski says he suffered a horrifying experience there. ...Dental Specialists of Boynton Beach, one of three locations illegally owned by non-dentist Evelyn Cruz, was also allegedly sending inflated bogus bills to insurance companies for work never done and pocketing the difference."

November 4, 2024

Experts warn some dentists are extracting ‘healthy’ and treatable teeth to profit from implants [Health News Florida]

"Americans are getting dental implants more than ever — and at costs reaching tens of thousands of dollars. Experts worry some dentists have lost sight of the soul of dentistry: preserving and fixing teeth...While implant dentistry was once the domain of a small group of highly trained dentists and specialists, tens of thousands of dental providers now offer the surgery and place millions of implants each year in the U.S. Amid this booming industry, some implant experts worry that many dentists are losing sight of dentistry’s fundamental goal of preserving natural teeth and have become too willing to remove teeth to make room for expensive implants, according to a months-long investigation by KFF Health News and CBS News. In interviews, 10 experts said they had each given second opinions to multiple patients who had been recommended for mouths full of implants that the experts ultimately determined were not necessary."