Best California Dental Insurance Plan for You

2025 California Dental Insurance Shopping Guide

California dental plans differ by benefits, covered dentist, and price. This guide will help you quickly find the best plan for you. We provide consumers with:

A Brief Guide for Bargain Hunters

While you can’t get rebates or discounts on individual dental insurance plans, you can get more value based on benefits and the cost of a dental plan. Below are two graphics that offer a shortcut to which dental plans might be best for you.

| Stop Researching & Start Shopping Dental Plans that Have What You Want |

|

| 3 Plans Covering Crowns | Ameritas Hollywood Smile Premier 1500 |

| Humana Loyalty Plus | |

| Cigna Dental Vision Hearing 3500 | |

| 3 Plans Covering Implants | Guardian Advantage Core |

| Anthem Blue Cross Essential Choice Incentive | |

| Delta Dental Dental for Everyone No Wait | |

| 3 Plans Covering Braces for Children | MetLife TakeAlong Dental High |

| Cigna Dental 1500 | |

| Guardian Advantage Diamond | |

| Highest Annual Maximum Benefit | ($10,000 annual maximum) NCD Complete by MetLife |

For more information on the above products as well as additional choices, go to our dental insurance comparison tool.

For more detailed information on the California dental insurance market, keep reading below.

Best California Dental Insurance Plans

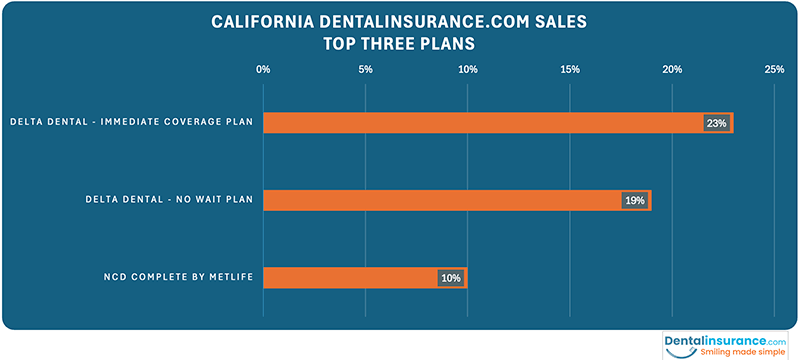

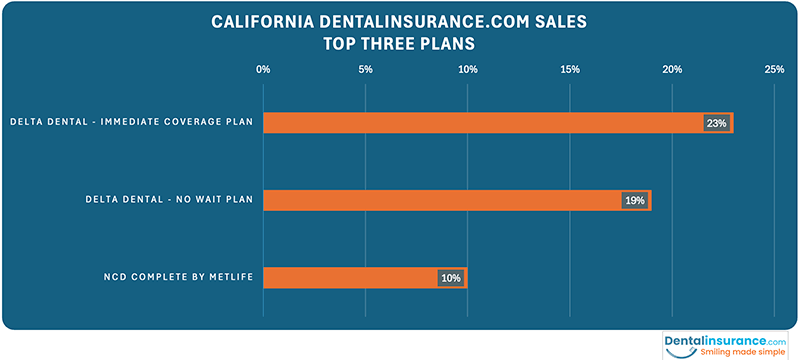

What makes a dental plan the best? We give you several ways to decide. Here are the best-selling dental plans for our customers in California based on a 12-month analysis. Below these plans are additional plans who excel in one or more aspects of dental coverage.

Top Plans by Coverage & Cost

Information in the table is based on a 32-year-old dental insurance applicant in California. Plans may not be available in all areas.

Dental Insurance Costs

Price quotes for dental insurance are affected by several factors. First and foremost, how many people will be covered by the plan? Is the policy for an individual, a married couple, or a family with several children or dependents? A second issues is that the same dental insurance plan may be priced differently across the state because of the regional cost of care (in other words the cost of dentists in Orange County may not be the same as in the Bay Area).

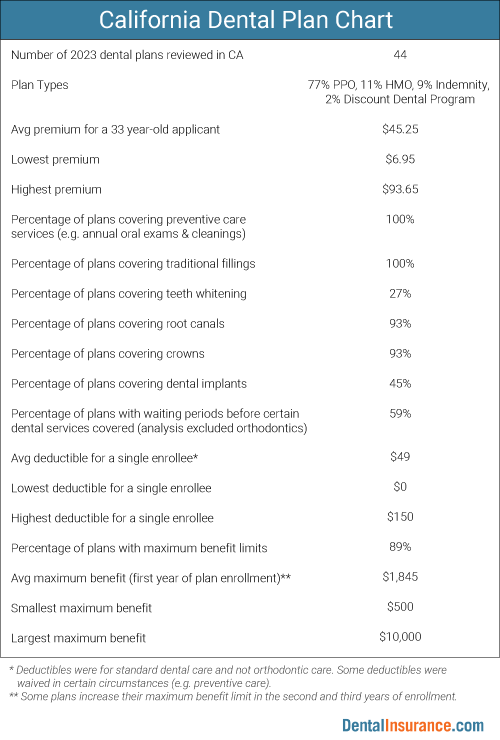

This 2023 DentalInsurance.com review of the California dental market examined 44 dental plans sold in the state. The lowest available premium (note - prices varied on state region) among the 44 options was $6.95 a month (Dental Health Services' SmartSmile DHMO) for a 33-year-old sample enrollee. The most expensive monthly premium was $93.65 for Nationwide's Classic 2000 + VSP Premium, a plan that combined dental benefits with vision coverage. For $85.44 a month, Delta Dental's Immediate Coverage Plan PPO offered broad coverage with no waiting periods. This option also included orthodontic coverage, which is less common among traditional dental plans.

Across the 44 dental plans examined, the average monthly premium for a thirty-three year-old Californian was $45.48. The companies offering the 44 plans examined were Ameritas, Anthem BlueCross, California Dental Network, Careington, Delta Dental, Dental Health Services, Guardian Dental, Humana Dental, MetLife Dental, Nationwide, NCD (who offered plans in partnership with MetLife and Nationwide), and Renaissance. This group represents a subset of all the insurers within the state. On California's Department of Insurance website, we found 52 corporate entities submitting Medical Loss Ratio information on 2021 California dental plans.

While we strongly recommend shopping on a combination of benefits, dentists, and premium, some consumers just want to know what the cheapest dental plans are. In our California study, we found several plans offered in various parts of the state that were under $20 a month in premiums (though premiums can vary by region):

- Dental Health Services SmartSmile (DHMO) $6.95

- Careington 500 Series Dental Savings (Discount Card) $8.95

- MetLife TakeAlong Dental HMO-Managed Care 245 (High) $11.02

- Dental Health Services Super SmartSmile (DHMO) $14.30

- California Dental Network Plan 595 (DHMO) $18.95

Finding the Best California Dental Insurance Plan for You

Depending on the insurance company, premiums may vary by region, number of enrollees, and other factors. However, a higher premium does not necessarily mean superior insurance coverage. Benefits vary significantly from one plan to another, and this variation does not neatly align with each plan's price. For example, 90.9 percent of the plans analyzed had a limit on how much the plan would pay annually toward an enrollee’s dental costs (this limit is called the "maximum benefit"). The lowest maximum benefit was $500 and the highest was $10,000 (NCD Complete by MetLife). It is important to note that three different plans were more expensive than the NCD Nationwide 5000 Plan but had maximum benefit limits thousands of dollars less. The average maximum benefit in the study was $1,818, which was 14 percent higher than 2022’s average of $1,597. Some plans had maximum benefits that increased in the second and third year of continuous enrollment and the average referenced above was based on the maximum limits applying to the first year of enrollment. 14 plans in the study had a maximum benefit higher than the state average and an additional four plans had no maximum benefit limits. The plans without the maximum benefit limits were HMO dental plans and one dental discount program (Careington 500 Series Dental Savings, which cost less than $10 a month).

38.6 percent of the 44 plans had no waiting periods on any of the covered services. A waiting period is a delay between the time an insurance plan becomes active and the date when a specific service will be paid for by the plan. Waiting periods are often placed on high-cost services such as crowns and root canals. Waiting periods are often as short as 90 days or as long as a year. A single plan had a waiting period of 18 months before major dental work was covered.

Out-of-pocket costs vary greatly for the same service. The average portion of a cavity filling fee covered by California PPO and indemnity dental plans was 61 percent</strong>. There were plans whose cost contribution was as low as 20 percent and others with contributions as high as 80 percent. Extractions had lower cost coverage among this group with an average of 44.4 percent of costs being covered (with several plans having no coverage for extractions in the first year of enrollment).

A Reputation Built on Trust

See why our customers trust us to help them find the right dental planMichael Alcala

Michael Alcala, met all the needs I had. He was patient, understanding, and had great customer services skills.Maria Aleman

Representative was courteous

Representative was courteous, informative, and provided me with the best plan that worked for my needs.Eva Rivera

Two-thirds of all dental plan types (66 percent) covered annual teeth cleaning with no out-of-pocket costs for the enrollee.

With respect to plans that included coverage of major dental services, the average insurance contribution for a crown was 31 percent for PPO and indemnity plans. This average was based on the first year of coverage (with some plans increasing contributions toward crowns in subsequent years of continuous enrollment). This average contribution percentage was the same for a root canal. HMO dental plans typically charged a flat copayment for a crown ($428 average among HMOs). Crown coverage is a critical issue for consumers with cracked or weakened teeth. Crowns are among the costliest dental procedures. The average price of a crown ranges from $800 to $1,700 according to WebMD> while our own review of dental crown costs would estimate the range between $500 and $2,000 depending on crown material used.

Deductibles were modest. On average, a single enrollee faced a $49 annual deductible. One-in-five plans (20 percent) had no deductible for enrollees. The highest deductible for an individual was $150 per year, but this deductible was paid only once for the entire time a person remained enrolled in the plan. Some plans with orthodontic coverage had a separate deductible for braces and related services. Families with multiple enrollees on the same dental plan may have a deductible per enrollee (e.g. $50 annually) or may have a maximum limit for the family deductible (e.g. $300 annually) regardless of the number of family members on the plan. About one-in-three plans (36 percent) had a maximum family deductible of $150 per year.

The differences in benefits among dental plans makes detailed shopping extremely important. California passed a law in 2018 (The Dental Plan Transparency Act) that requires dental plans (starting in 2021) to provide a standardized benefit form for their plans that allow consumers to review the plan’s:

- Dental plan reimbursement rates and estimated out-of-pocket cost for covered services

- Annual plan deductible

- Annual benefit limit

- Coverage conditions pertaining to preventive, basic, and major dental services</li>

- Any waiting periods that delay benefit coverage

Need some help choosing a dental plan?

Our agents can:

- Answer your questions

- Confirm if your dentist is in-network

- Enroll you over the phone

Dentist Networks

According to data published by Statista, California has more active dentists than any other state. Over 30,000 dentists practice in California. A dental plan's coverage is a critical aspect of dental insurance value. You should always confirm your dentist is not out-of-network prior to completing a dental insurance application so that you can reduce your risk of higher out-of-pocket costs. Services received from an out-of-network dentist can result in higher dental care bills and no payment assistance from your dental plan.

Plans may be health maintenance organizations (known as HMOs or DHMOs), preferred provider organizations (PPOs or DPPOs), indemnity plans, or discount dental programs. PPO dental plans typically have wider networks of dentists than HMO dental plans but may have higher out-of-pocket costs. Additionally, a HMO may not have a limit on annual benefits but, along with restrictive networks, they also require your dentist to provide a referral to an in-network provider when specialist care is required. 77 percent of the California plans examined were preferred provider organizations. Only one was a discount program and 9 percent were indemnity plans. The remainder were HMOs.

Indemnity dental plans warrant a mention as well as discount programs. An indemnity dental plan allows a person to use any dentist of his or her choice. However, the enrollee pays upfront for the dental service and then the indemnity plan will send a fixed reimbursement back to the enrollee for the care. The difference between the cost of care versus an indemnity plan’s reimbursement can be significant. Additionally, not all dental services may be covered by an indemnity plan.

A dental discount program, in contrast, charges a monthly fee to enrollees and then the enrollees receive a discount on the standard price of dental care from participating dentists. These programs normally do not have a limit on annual benefits, but the level of discount may still leave considerable costs to be covered by the enrollee.

Regional Differences

Los Angeles Dental Insurance

Los Angeles is home to nearly four million residents. With its extreme population density, the city has a wide variety of plan options for consumers. Below is an example of what dental plans are available.

| Plan Name | Network Type | Maximum Benefit | Est. Premium for a 32 year-old applicant |

| Ameritas Dallas Smile Plus | PPO | $2,000 - $3,500 | $62.08 |

| Ameritas Hollywood Smile Advantage | PPO | $1,500 | $36.41 |

| Ameritas Hollywood Smile Elite | PPO | $2,500 | $46.69 |

| Anthem BlueCross Essential Choice Bronze | PPO | $1,000 | $25.20 |

| Anthem BlueCross Essential Choice Gold | PPO | $1,500 | $50.75 |

| Anthem BlueCross Essential Choice Incentive | PPO | $2,500 | $57.75 |

| Anthem BlueCross Essential Choice Platinum | PPO | $2,000 | $60.50 |

| Anthem BlueCross Essential Choice Silver | PPO | $1,000 | $39.75 |

| California Dental Network Plan 595 | HMO | N/A | $18.95 |

| Careington 500 Series Dental Savings | Discount Card | N/A | $12.95 |

| Cigna Dental 1500 | PPO | $1,500 | $47.00 |

| Cigna Dental Vision Hearing 3500 | PPO plus Vision & Hearing | $2,500 | $69.64 |

| Delta Dental Dental for Everyone Gold | PPO | $1,000 | $50.46 |

| Delta Dental Dental for Everyone Immediate Coverage | PPO | $3,000 | $93.16 |

| Delta Dental Dental for Everyone No Wait | PPO | $2,000 | $66.11 |

| Delta Dental Dental for Everyone Platinum | PPO | $2,500 | $68.44 |

| Guardian Advantage Achiever | PPO | $1,000-$1,500 | $44.93 |

| Guardian Advantage Core | PPO | $500-$1,000 | $30.87 |

| Guardian Advantage Diamond | PPO | $1,500 | $56.43 |

| Guardian Advantage Premier | PPO | $3,000 | $72.23 |

| Guardian Advantage Starter | PPO | $500-$1,000 | $23.16 |

| Humana Bright Plus | PPO | $1,250 | $26.54 |

| Humana Extend 2500 | PPO plus Vision & Hearing | $2,500 | $66.99 |

| Humana Extend 5000 | PPO plus Vision & Hearing | $5,000 | $99.99 |

| Humana Loyalty Plus | PPO | $1,000-$1,500 | $46.99 |

| MetLife TakeAlong Dental High | PPO | $2,000 | $55.26 |

| MetLife TakeAlong Dental HMO-Managed Care 245 (High) | HMO | N/A | $11.02 |

| MetLife TakeAlong Dental HMO-Managed Care 350 (Low) | HMO | N/A | $7.50 |

| MetLife TakeAlong Dental Medium | PPO | $1,500 | $47.00 |

| NCD Complete by MetLife | PPO | $10,000 | $91.00 |

| NCD Elite 3000 by MetLife | PPO | $3,000 | $72.00 |

| NCD Elite 5000 by MetLife | PPO | $5,000 | $82.00 |

| NCD Essentials by MetLife | PPO | $2,000 | $72.00 |

| Renaissance Dental Max Choice | PPO | $1,200 | $64.49 |

| Renaissance Dental Max Choice Plus | PPO | $1,000-$3,000 | $98.38 |

| Renaissance Dental Plan II | PPO | $1,000 | $37.44 |

| Renaissance Dental Plan III | PPO | $1,000 | $45.84 |

San Diego Dental Insurance

San Diego, located at the very south end of the state, is a mid-sized city with over a million people calling it home. Because of differences in the cost of dental care, some San Diego plans are less expensive than the same plan offered in Los Angeles.

| Plan Name | Network Type | Maximum Benefit | Est. Premium for a 32 year-old applicant |

| Ameritas Dallas Smile Plus | PPO | $2,000 - $3,500 | $62.08 |

| Ameritas Hollywood Smile Advantage | PPO | $1,500 | $36.41 |

| Ameritas Hollywood Smile Elite | PPO | $2,500 | $46.69 |

| Anthem BlueCross Essential Choice Bronze | PPO | $1,000 | $25.20 |

| Anthem BlueCross Essential Choice Gold | PPO | $1,500 | $50.75 |

| Anthem BlueCross Essential Choice Incentive | PPO | $2,500 | $57.75 |

| Anthem BlueCross Essential Choice Platinum | PPO | $2,000 | $60.50 |

| Anthem BlueCross Essential Choice Silver | PPO | $1,000 | $39.75 |

| California Dental Network Plan 595 | HMO | N/A | $18.95 |

| Careington 500 Series Dental Savings | Discount Card | N/A | $12.95 |

| Cigna Dental 1500 | PPO | $1,500 | $44.00 |

| Cigna Dental Vision Hearing 3500 | PPO plus Vision & Hearing | $2,500 | $73.13 |

| Delta Dental Dental for Everyone Gold | PPO | $1,000 | $46.07 |

| Delta Dental Dental for Everyone Immediate Coverage | PPO | $3,000 | $86.44 |

| Delta Dental Dental for Everyone No Wait | PPO | $2,000 | $60.15 |

| Delta Dental Dental for Everyone Platinum | PPO | $2,500 | $62.25 |

| Dental Health Services SmartSmile | HMO | N/A | $6.95 |

| Dental Health Services Super SmartSmile | HMO | N/A | $14.30 |

| Guardian Advantage Achiever | PPO | $1,000-$1,500 | $44.93 |

| Guardian Advantage Core | PPO | $500-$1,000 | $30.87 |

| Guardian Advantage Diamond | PPO | $1,500 | $56.43 |

| Guardian Advantage Premier | PPO | $3,000 | $72.23 |

| Guardian Advantage Starter | PPO | $500-$1,000 | $23.16 |

| Humana Bright Plus | PPO | $1,250 | $26.54 |

| Humana Extend 2500 | PPO plus Vision & Hearing | $2,500 | $66.99 |

| Humana Extend 5000 | PPO plus Vision & Hearing | $5,000 | $99.99 |

| Humana Loyalty Plus | PPO | $1,000-$1,500 | $46.99 |

| MetLife TakeAlong Dental High | PPO | $2,000 | $51.64 |

| MetLife TakeAlong Dental HMO-Managed Care 245 (High) | HMO | N/A | $11.02 |

| MetLife TakeAlong Dental HMO-Managed Care 350 (Low) | HMO | N/A | $7.50 |

| MetLife TakeAlong Dental Medium | PPO | $1,500 | $43.89 |

| NCD Complete by MetLife | PPO | $10,000 | $88.00 |

| NCD Elite 3000 by MetLife | PPO | $3,000 | $72.00 |

| NCD Elite 5000 by MetLife | PPO | $5,000 | $82.00 |

| NCD Essentials by MetLife | PPO | $2,000 | $69.00 |

| Renaissance Dental Max Choice | PPO | $1,200 | $64.49 |

| Renaissance Dental Max Choice Plus | PPO | $1,000-$3,000 | $98.38 |

| Renaissance Dental Plan II | PPO | $1,000 | $37.44 |

| Renaissance Dental Plan III | PPO | $1,000 | $45.84 |

San Francisco Dental Insurance

San Francisco, while the biggest city in the Bay Area, is still smaller than both Los Angeles and San Diego. Despite that, it has a thriving insurance market as revealed in the list of plans below.

| Plan Name | Network Type | Maximum Benefit | Est. Premium for a 32 year-old applicant |

| Ameritas Dallas Smile Plus | PPO | $2,000 - $3,500 | $62.08 |

| Ameritas Hollywood Smile Advantage | PPO | $1,500 | $36.41 |

| Ameritas Hollywood Smile Elite | PPO | $2,500 | $46.69 |

| Anthem BlueCross Essential Choice Bronze | PPO | $1,000 | $25.20 |

| Anthem BlueCross Essential Choice Gold | PPO | $1,500 | $50.75 |

| Anthem BlueCross Essential Choice Incentive | PPO | $2,500 | $57.75 |

| Anthem BlueCross Essential Choice Platinum | PPO | $2,000 | $60.50 |

| Anthem BlueCross Essential Choice Silver | PPO | $1,000 | $39.75 |

| California Dental Network Plan 595 | HMO | N/A | $18.95 |

| Careington 500 Series Dental Savings | Discount Card | N/A | $12.95 |

| Cigna Dental 1500 | PPO | $1,500 | $49.00 |

| Cigna Dental Vision Hearing 3500 | PPO plus Vision & Hearing | $2,500 | $70.08 |

| Delta Dental Dental for Everyone Gold | PPO | $1,000 | $38.51 |

| Delta Dental Dental for Everyone Immediate Coverage | PPO | $3,000 | $66.82 |

| Delta Dental Dental for Everyone No Wait | PPO | $2,000 | $49.93 |

| Delta Dental Dental for Everyone Platinum | PPO | $2,500 | $51.65 |

| Guardian Advantage Achiever | PPO | $1,000-$1,500 | $44.93 |

| Guardian Advantage Core | PPO | $500-$1,000 | $30.87 |

| Guardian Advantage Diamond | PPO | $1,500 | $56.43 |

| Guardian Advantage Premier | PPO | $3,000 | $72.23 |

| Guardian Advantage Starter | PPO | $500-$1,000 | $23.16 |

| Humana Bright Plus | PPO | $1,250 | $26.54 |

| Humana Extend 2500 | PPO plus Vision & Hearing | $2,500 | $66.99 |

| Humana Extend 5000 | PPO plus Vision & Hearing | $5,000 | $99.99 |

| Humana Loyalty Plus | PPO | $1,000-$1,500 | $46.99 |

| MetLife TakeAlong Dental High | PPO | $2,000 | $55.26 |

| MetLife TakeAlong Dental HMO-Managed Care 245 (High) | HMO | N/A | $11.02 |

| MetLife TakeAlong Dental HMO-Managed Care 350 (Low) | HMO | N/A | $7.50 |

| MetLife TakeAlong Dental Medium | PPO | $1,500 | $47.00 |

| NCD Complete by MetLife | PPO | $10,000 | $96.00 |

| NCD Elite 3000 by MetLife | PPO | $3,000 | $76.00 |

| NCD Elite 5000 by MetLife | PPO | $5,000 | $87.00 |

| NCD Essentials by MetLife | PPO | $2,000 | $79.00 |

| Renaissance Dental Max Choice | PPO | $1,200 | $64.49 |

| Renaissance Dental Max Choice Plus | PPO | $1,000-$3,000 | $98.38 |

| Renaissance Dental Plan II | PPO | $1,000 | $37.44 |

| Renaissance Dental Plan III | PPO | $1,000 | $45.84 |

How Can You Enroll? When Can You Enroll?

Private dental insurance does not have a set annual enrollment period. You can enroll in coverage any time of year. You can also change plans or discontinue coverage during the year. Group dental plans, offered by employers, normally have an annual enrollment period and won’t let you apply for coverage outside that time unless you qualify for a Special Enrollment Period (e.g. you were recently hired, you had a childbirth or adopted a child, you recently married, etc.).

Enrollment in a dental plan is easy. Go to the top of the page and click the button labeled Get Price Quotes. The button will bring you to a page where you can specify how many people need to be covered by the plan (e.g. you alone, you and family members). The page also asks for your zip code so it can filter out plans not available for your region.

When the plans are displayed, click the Apply Now button on the plan best suited to your needs. At this point, the application form starts, and you can complete the form in a minute or two. After you submit your plan, you will receive an email notification confirming your enrollment.

Oral Health Trends in California

A study performed by the L.A. County Department of Public Health found that 59 percent of Los Angeles residents visited a dentist in 2015. Given the size of the city's population, this means approximately three million residents didn't see a dentist. Another unfortunate city trend identified by the study was that less than half the people earning below 200 percent of the Federal Poverty Level had visited a dentist in the past year (45 percent).

State Averages Vs Your Region

With the information provided in this study, you can compare your local rates to larger state trends whether you live up north in the San Francisco area or somewhere down south such as Los Angeles or San Diego. The following link will get dental insurance quotes for plans available in any California zip code.

Dental Insurance Trends: California Dental Plan Statistics

Frequently Asked Questions

What Is the Best California Dental Insurance?

While “best” entails some subjectivity and consideration of personal circumstances, there are many California dental insurance plans with broad benefit coverage or a high maximum benefit. For example, preventive, basic, and major care are all covered by plans such as Delta Dental Dental for Everyone Immediate Coverage, California Dental Network Plan 595, Humana Extend 2500, and Cigna Dental Vision Hearing 3500.

With respect to the best maximum benefit, Humana offers a dental in New York with a $5,000 maximum benefit (Humana Extend 5000). A maximum benefit is the cap on patient spending that an insurance company has per enrollment year. Maximum benefits are normally found on PPO and indemnity dental plans but not HMOs or dental discount cards.

Is There Cheap Dental Insurance in California?

A review of 44 plans in the state found 4 that offered coverage at premiums below $20 a month. These plans are the TakeAlong Dental HMO-Managed Care 350 (Low) and the TakeAlong Dental HMO-Managed Care 245 (High). Careington dental discount card, the 500 Series Dental Savings, is not insurance but offers rebated services within a dentist network and charged a fee under $10 a month for members.

How Much is Dental Insurance in California?

A 2023 analysis of over 40 dental plans in the state found the average premium was $45.48 a month. The lowest monthly premium in the study was $6.95 for the TakeAlong Dental HMO-Managed Care 350 (Low) and the highest premium was $99.99 for the Humana Extend 5000

What is the Average Maximum Benefit for California Dental Plans?

The average maximum benefit was $1,818 for the 44 California dental insurance options examined in 2023.

Oral Health Resources for Californians

We've pulled together information to help you find resources in your state to help you maintain your oral health.

California Dental Association (CDA)

Over the past 150 years, CDA has grown to become the single largest chapter of the American Dental Association and a trusted resource for California dentists and their patients.

Oral Health Resources for Californians

This page at the CDA site provides answers to questions about dental benefit plans, issues affecting seniors or those with special needs, and information about low-cost or free dental services.

Free or Low-Cost Dental Clinics in California

This online resource lists a variety of free and low-cost dental providers grouped by county.

Medi-Cal Dental

Medi-Cal, the Medicaid program for the state of California, covers dental services among its variety of medical benefits. Medi-Cal Dental is also known in California as Denti-Cal.

California Dental Insurance News

May 9, 2025

California Dentist Warns Against TikTok DIY Dental Trends [Dentistry Today]

"Dr. Anjali Rajpal, DMD, founder of Beverly Hills Dental Arts, commented on five popular DIY dental procedures that are popular on TikTok. She has warned that such procedures found online don’t always deliver safe or effective results."

March 13, 2025

Bill Aims To Prevent Dental Insurance Companies From Denying Care (Patch)

"Assembly Bill 371 would mandate that dental insurance companies in the state provide enrollees access to in-network dentists within 15 miles of the patient's residence or workplace. Existing law does not specify that dental insurance companies have to abide by distance parameters for care they cover. It would also ban dental insurance companies from forcing enrollees to pay out-of-pocket for services covered in their insurance plan. That would prevent insurance companies from subsequently denying coverage for patients who seek services out-of-network, despite having insurance plans that are supposed to cover out-of-network care."

September 30, 2024

New Law Brings New Dental Coverage and Reporting Requirements [Keenan]

“Due to the passage of AB 1048 (Chapter 557, Statutes of 2023) in 2023, California dental plans will soon have to meet new coverage requirements and dental carriers will have additional information to report to state regulators. Most importantly for employers and dental plan members, AB 1048 prohibits fully insured large group dental plans from imposing a dental waiting period or preexisting condition provision for any plan year beginning on or after January 1, 2025.”

September 25, 2024

California Dental Association disappointed by Gavin Newsom’s veto of bill restricting virtual credit cards [California Dental Association]

"Dental plan use of VCCs to pay for dental services has exploded in recent years, resulting in high fees charged to dental offices that divert resources away from patient care and line the pockets of third-party companies. Unjustly high VCC processing fees can take up to 10% of the amount paid by dental plans for treatment, denying dental practices the full reimbursement they are owed for contracted services…SB 1369, authored by Sen. Monique Limón (D-Santa Barbara), would have addressed this predatory behavior by simply barring dental plans from using virtual credit cards as the default method when reimbursing dentists, and would have required plans to provide a clear and permanent opt out process."

January 31, 2025

As RFK eyes fluoride in water, California bill would make kids’ dental treatment covered [The Sacramento Bee]

"One California lawmaker is looking to ensure kids and young adults can access fluoride treatment as Robert F. Kennedy Jr. — a critic of fluoridated water — faces Senate confirmation to lead the nation’s health agencies. Kennedy, President Donald Trump’s pick to lead the U.S. Department of Health and Human Services, has called fluoride an “industrial waste” associated with a raft of health issues such as bone cancer, thyroid disease and lower IQ."